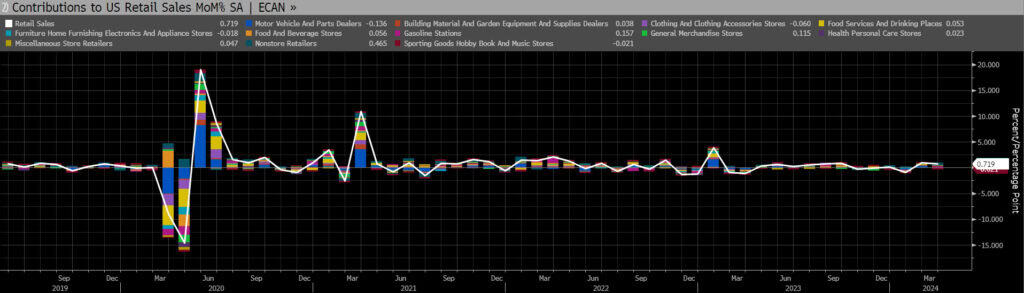

Bond yields have been back-and-forth this week as markets work to digest an inflationary Retail Sales number with a potentially escalating situation between Israel and Iran in the Middle East. Following last week’s higher-than-expected CPI number, markets looked to Retail Sales to gauge the temperature of the Consumer and were further rattled when the headline number came in at 0.7% vs the expectation of 0.4%. Diving deeper into the number, much of the uptick in consumer spending was driven by online sales, while sales for larger ticket items like autos, furniture and appliances declined. This may suggest that consumers are attentive to higher interest rates and are being selective with their spending even as spending is being driven by higher incomes.

Increased consumer spending in the face of persistent inflation could cause one to wonder if the Fed feels their current policy is restrictive enough, fortunately 4 of the 12 voting members of the Fed went on record this week including Fed Chair Jerome Powell and John Williams (President of the New York Fed and permanent voting member) to give their thoughts.

John Williams, New York Fed (April 15) – “I do think we have restrictive monetary policy. I do think policy is tight.”

Jerome Powell, Fed Chair (April 16) – “Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.”

Michelle Bowman, Board of Governors (April 17) – “I think it is restrictive. I think time will tell whether it is sufficiently restrictive.”

Raphael Bostic, Atlanta Fed (April 18) – “Right now where our stance is, I think is a restrictive stance, it will slow the economy down and eventually get us to 2%”

Without letting on too much, members of the Fed seem to feel they are currently adequately restrictive, but “higher-for-longer” isn’t out of the question. Fed Funds Futures are projecting between 1-2 rate cuts of 25bps by year-end with only a -2.6% chance of a rate cut at the next Fed meeting in May.

Looking forward to next week, we’ll get a look at 1st Quarter GDP and the Bureau of Economic Analysis’ Personal Income and Expenditures numbers. Hope everyone has a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.