This morning’s hotly anticipated inflation report seems to have markets focused on the silver lining. Although March’s Personal Consumption Expenditure (PCE) reading was strong, it wasn’t strong enough to completely erode the case for interest rate cuts this year. Given the bond market’s reaction to the less than 1bp miss in March’s monthly CPI reading just two weeks ago (which caused the 10-year yield to soar more than 20bps intraday), you’d be forgiven for thinking rates would be up this morning. Instead, markets are feeling Jim Carey’s famous line from Dumb and Dumber, “So you’re telling me there’s a chance!” The 2-year UST is currently down 2bps from yesterday’s close at 4.97%, the 5-year is down almost 5bps at 4.66%, and the 10-year is down 5bps at 4.65%.

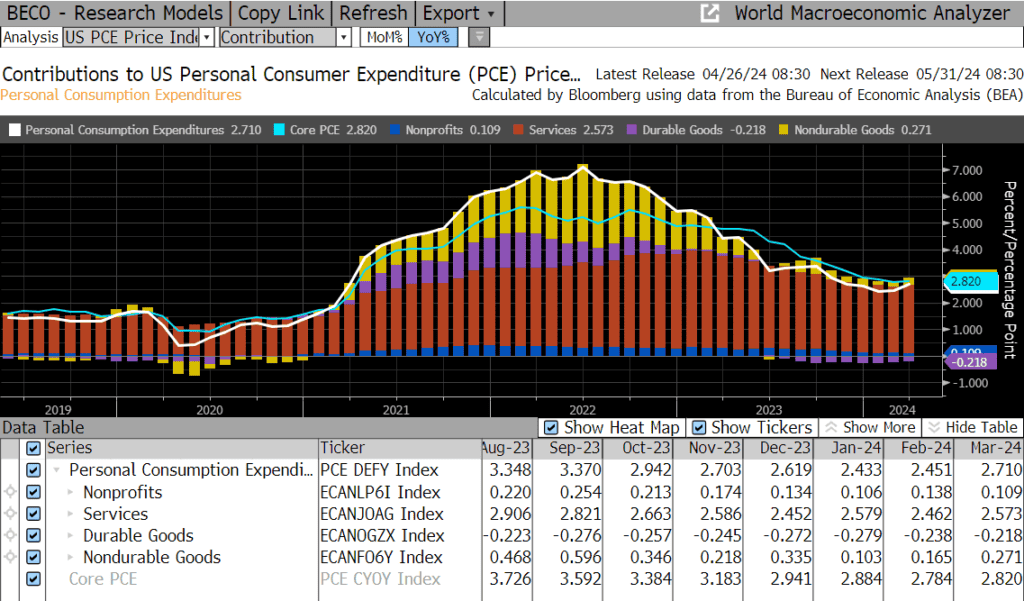

March’s monthly PCE readings were in line with expectations, but the year-over-year readings came in stronger than forecast. Headline inflation rose 0.3% in March (survey also 0.3%) and 2.7% from a year ago (survey 2.6%). Excluding food and energy, Core PCE rose 0.3% (survey also 0.3%) and 2.8% from a year ago (survey 2.7%). The uptrend will undoubtedly worry some at the Fed ahead of their policy meeting next week. Of particular concern to policymakers is the measure of services less housing, which has been particularly sticky. That metric accelerated MoM, coming in at 0.4% for the month of March.

Personal Income levels were in line with expectations, but personal spending rose more than expected. Income rose 0.5% in March (0.5% survey), but personal spending climbed 0.8% (vs. 0.6% survey). A robust labor market is likely at least partly to blame for persistently strong spending in the U.S., despite higher prices and higher interest rates. However, because spending levels are outpacing income gains, more and more of that spending is now on credit, reinforcing the concern that the only thing able to fully put inflation to bed will be a recession.

Also this week we got a rare downside surprise in Q1 GDP data, which showed the initial reading of first quarter growth at 1.6%, much lower than the estimate of 2.5%. For the last several quarters, GDP growth had been posting stronger than expected gains. This was the softest reading since the second quarter of 2022, and perhaps reflects some pullback resulting from the higher rate environment and overall higher costs related to inflation.

Housing data came in mostly stronger than expected for the month of March. New Home Sales popped 8.8% MoM (vs. 0.9% expected), to a 693k annualized pace. This is the fastest increase since September as an abundance of inventory helped drive prices lower. The supply of new homes rose to 477k in the month of March, the highest level of inventory since 2008. Pending Home Sales also climbed to their highest level in a year, rising 3.4% in the month of March (vs. 0.4% expected). Although the measure has reached a recent high point, it remains very low overall and not likely to show meaningful gains without a substantial decline in mortgage rates and increase in inventory.

Next week is packed with important data and economic events. As is customary, the first week of the month will provide a slew of data points on the state of the labor market, culminating with the all-important Employment Situation Report (aka. non-farm payrolls and unemployment rate) on Friday. The FOMC also has its next policy meeting next week with their latest rate decision and post-meeting press conference scheduled for Wednesday. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.