Happy Jobs Friday, everyone! It has been an exciting week here in Oklahoma City as our hometown Thunder swept the New Orleans Pelicans to win their first playoff series since 2016. It has also been an exciting week for the markets, as we have had a litany of economic data come out along with the FOMC meeting that was on Wednesday.

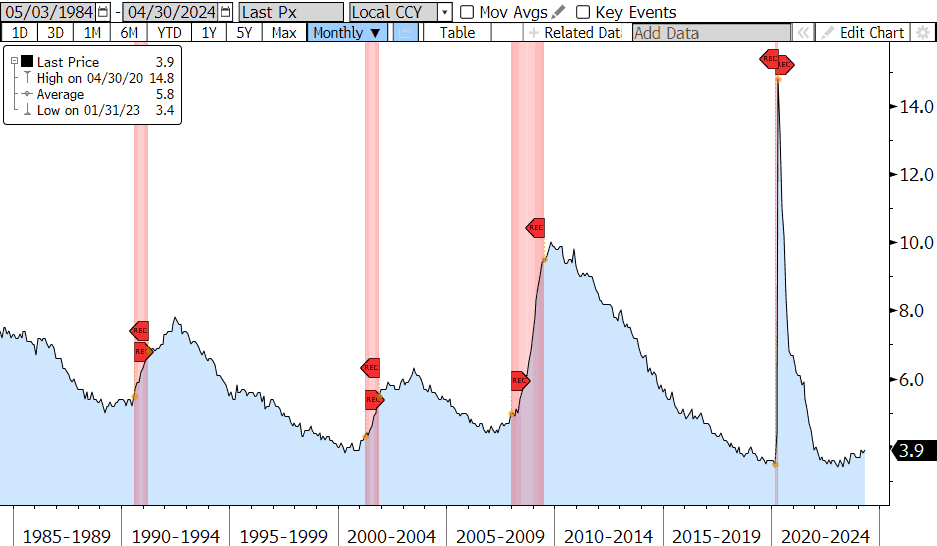

This morning’s Bureau of Labor Statistics (BLS) jobs numbers marked the smallest gain in 6 months, with a gain of 175,000 in Nonfarm Payrolls versus an estimated 240,000. The largest gains were in health care (+55,000), social assistance (+31,000), transportation and warehousing (+22,000) and retail trade (+20,000). The change in transportation and warehousing jobs had shown little change over the last 12 months, prior to today’s report. Retail job growth remains strong as consumers continue to spend and the hiring needs of retail stores continues to grow. The prior two months’ jobs reports were revised down by a net loss of 22,000 and the unemployment rate has ticked back up to 3.9%. The unemployment rate has now risen 0.5% since April of 2023. While the unemployment rate is still under 4% this overall level of change has historically led to the beginning of a recession, however this is not the current consensus forecast. Average hourly earnings stayed relatively steady, rising 0.2% versus an estimate 0.3% in April and 3.9% from a year go versus an estimated 4.0%. This marks the first time annual wage gains have been below 4.0% since June of 2021. Finally, the labor force participation rate remained unchanged at 62.7% matching expectations.

The BLS also released the monthly JOLTS survey on Wednesday. The survey showed that job openings fell more than expected at 325,000 in March to a total of 8.488mm, which is the lowest level of openings in more than 3 years. The JOLTS survey also showed quits fell 198,000, hires fell 281,000 and layoffs fell 155,000. The recent jobs data provided signs of labor market conditions starting to ease and a return to a better overall balance between supply and demand, which ultimately could aid the Fed’s goal to bring inflation down to 2.0%.

The FOMC decided to maintain the target range for the federal fund rate at 5.25%-5.50% following their Wednesday Meeting, noting that “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent”. Chairman Powell stated in his press conference that “We are prepared to maintain the current target range for the federal funds rate for as long as appropriate. We are also prepared to respond to an unexpected weakening in the labor market.” This morning’s jobs report provides some weight to this comment as Fed Funds futures are now pricing in the first full rate cut by September, previously priced in for November/December, and two full cuts by the end of the year.

The stock market seems to be digesting this data very well, as the Dow Jones Industrial Average is currently up 367 points. Treasury yields fell across the board this morning after the BLS report with the 10 Year UST currently at 4.53%, down from 4.68% on Tuesday.

Next week we look forward to the University of Michigan’s Consumer Sentiment preliminary report where consumer sentiment is expected to tick down slightly to 76.8% from 77.2%, and the Initial Jobless Claims report.

I hope everyone has a great weekend! Thunder up!

US Unemployment Rate (1984-Current)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President, Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.