This week’s economic calendar offered plenty of potential for market volatility, however, market yields remained fairly stable with headline numbers staying in-line with analyst expectations. The main outlier of the week came on Tuesday, when the Bureau of Labor Statistics released its Producer Price Index (PPI) report which came in higher than expected, and the highest level since April 2023, at 0.5% vs 0.3%. Markets were initially spooked as several of the categories that are used in the PPI are also used to calculate PCE, which is the Fed’s preferred measure of inflation. Upon further review of the data, markets eased noticing that many of the underlying components that feed into PCE actually declined. PCE will come out later this month, but this report was viewed as somewhat encouraging by market participants.

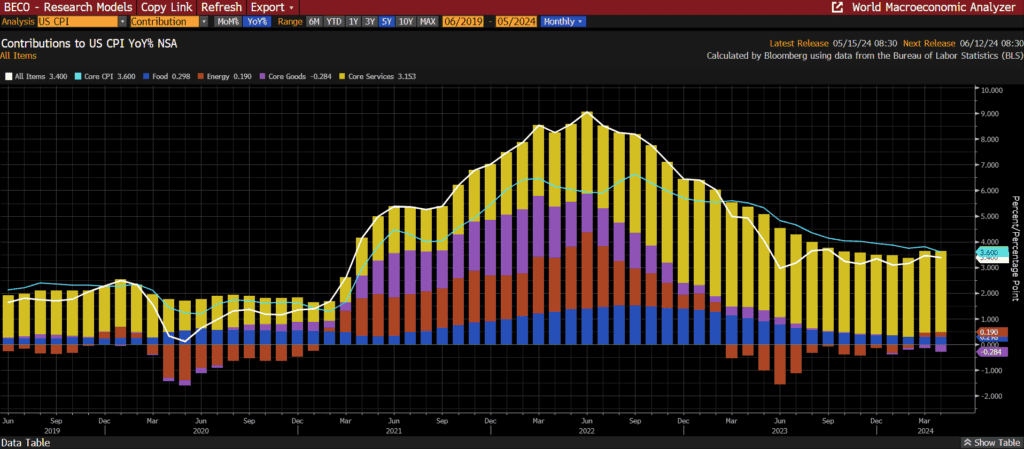

Continuing on the topic of inflation, the BLS also released April’s CPI report which marked the lowest monthly gain in Core CPI for the year. Additionally, the Core CPI number at 3.6% YoY was the lowest number in 3 years. Shelter costs continue to be the largest contributor to inflation accounting for roughly. Motor Vehicle Insurance was also a big contributor as the cost of insurance has accelerated significantly this year. Big ticket items including new and used vehicles, and household furnishings continued to cool for the year suggesting that consumers are feeling the impact of higher interest rates. Furthermore, the retail sales number came in unexpectedly flat at 0.0% vs 0.4% expected. Retail Sales are not adjusted for inflation so this report suggests real consumer spending may have actually fallen in April and could point to another weak quarter for GDP growth.

Rounding out the week, Initial Jobless Claims and Continuing Claims stayed largely in-line with expectations. Earlier this morning, the Conference Board released its Leading Economic Indicators Index which came in negative for the 26th time in the last 28 months.

Next week we’ll get a look at New and Existing Home Sales and May’s finalized report of the University of Michigan Consumer Sentiment Index. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.