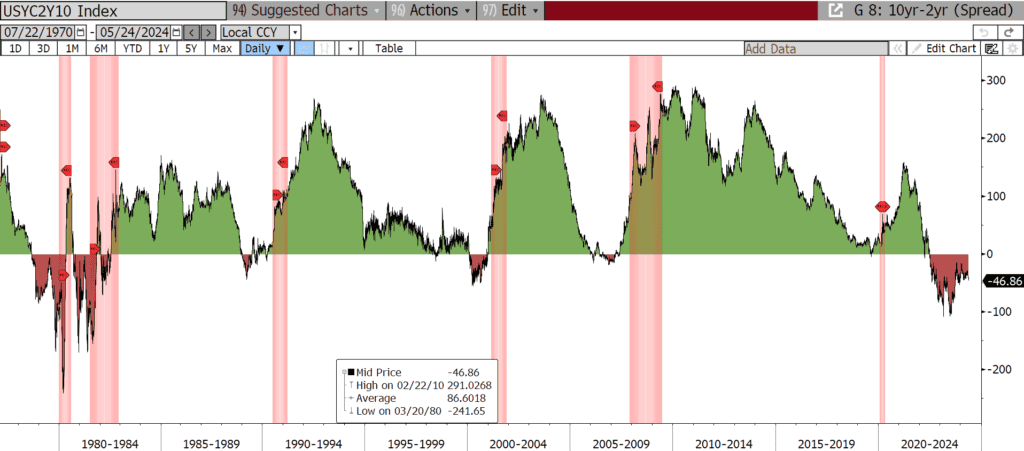

With little on the data-front but second-tier economic releases, much of this week’s attention focused on Fed speakers and minutes from the April 30-May 1 FOMC meeting that were released on Wednesday. The tone of this week’s speakers and the minutes themselves were fairly hawkish. The yield curve saw further bear flattening in response, which caused the inversion of the 2s10s curve to deepen to its most negative of the year. Bear flattening happens when restrictive Fed policy keeps short rates elevated but the market expects slower growth in the future. The yield curve (2s10s) has now been inverted for almost two years, longer than at any time on record, and historically a reliable harbinger of recessions. However, the recession has not come, and the inversion continues, underscoring peculiarity of this particular cycle.

There were signs in the FOMC minutes that some particularly hawkish policymakers were willing to lift rates again if necessary, but market reaction to the prospect was muted because the meeting took place before the softer April inflation data. Further softness in housing data this week also helped buoy hopes for a cooling economy. Existing home sales, which were expected to pick up 0.8% instead fell for a second straight month, coming in at -1.9% MoM. Housing prices remain high, and the median selling price rose again to $407,600, up 5.7% from a year ago. New home sales also fell more than expected, dropping 4.7% MoM (vs. -2.2% survey). The prior month’s purchases were also revised down. New home sales, unlike existing home sales which still suffer from a lack of inventory, have largely stabilized over the past year, suggesting that although demand remains strong, buyers are restrained by affordability challenges.

Futures markets have fully priced in one full cut from the Fed this year plus about a third of another cut as of this morning. At the start of the year markets had six cuts priced in. The reversal is largely due to the strength of the economy in the face of restrictive Fed policy and the slow last mile of the inflation fight which keeps the Fed hesitating on a first rate cut.

Next week will be short after the Memorial Day holiday on Monday but no less important as we get the much-anticipated release of April’s Personal Consumption Expenditures (PCE) report, the Fed’s preferred measure of inflation. We will also get additional housing data and business activity readings as well as GDP. Hope everyone has a wonderful holiday. Thank you to all who have served our country and to the family and friends who support them. Happy Memorial Day!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.