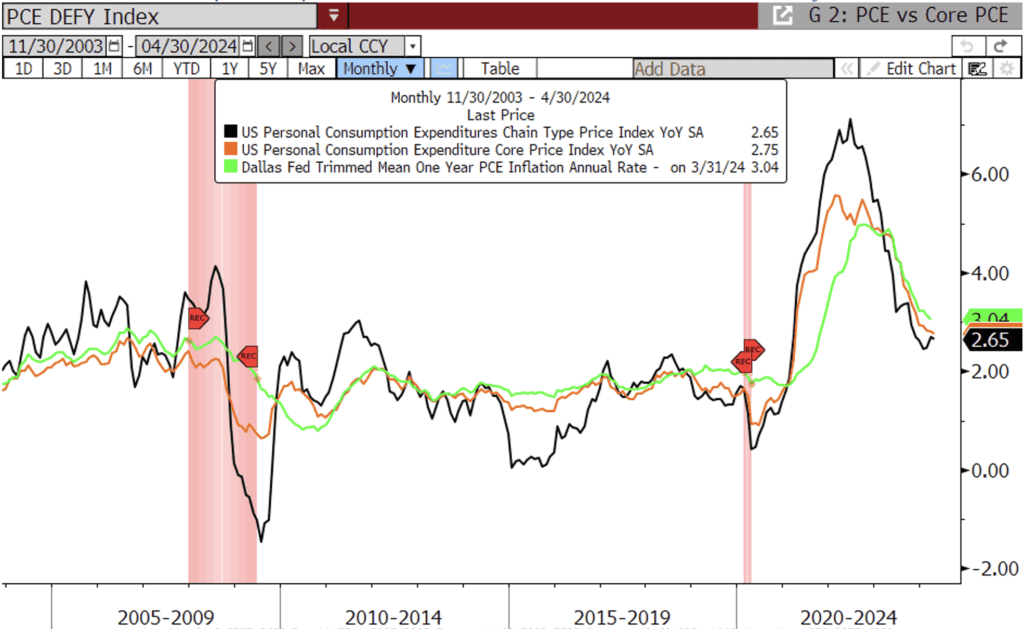

Markets are opening green across the board this morning as welcome news on the inflation front has traders upbeat this last day of May. Personal Consumption Expenditures (PCE), the Fed’s preferred inflation gauge, hit all the right marks this morning, printing in line with expectations and showing inflation cooling modestly in the month of April. The comprehensive headline measure showed inflation rising 0.3% MoM and 2.7% YoY. The core measure, which strips out the volatile food and energy components to better depict the underlying trend of inflation, showed inflation rising 0.2% MoM and 2.8% YoY. This brings core inflation quite close to where the Fed expects it to be by the end of the year (2.6%), according to their last Summary of Economic Projections.

This morning’s report also showed that consumer spending, the driving force behind the US economy, slowed in April. Real Personal Spending, which is an inflation-adjusted spending number that reflects the actual amount of goods and services people are buying rather than a number that can be higher simply due to higher prices, fell into negative territory for the month of April, coming in at -0.1% vs. +0.1% forecast. With household debt hitting a record high last quarter and consumer confidence also waning, the prospect of consumers continuing to power the economy at a robust pace seems questionable.

Economic growth has already turned sharply lower in the first quarter of this year compared to the substantial expansion we saw at the tail end of last year. Data released Thursday showed that the US economy grew at a slower pace than originally reported in the first quarter. Q1 GDP was revised down to 1.3% from 1.6% in the initial print, a considerable drop from Q4 2023 GDP which was 3.4%. The downward revision was attributed to softer consumer spending on goods. High interest rates, fading pandemic savings, and slower income growth are forcing Americans to pull back their spending habits and lowering growth prospects for the remainder of 2024 as well.

The yield curve further inverted over the week, with short rates down a few bps from last Friday and long rates up slightly. The 2-year is currently down 7bps on the week to 4.87%, the 5-year is down about 2bps to 4.50%, and the 10-year is up about 2.5bps to 4.49% at the time of this writing. Fed funds futures markets are still expecting about a 50-50 chance of a first rate cut at the Fed’s September meeting and have about 1.5 rate cuts priced in by the end of the year.

Next week will be an important one as we kick off the month of June with several readings on the state of the labor market culminating with the Employment Situation Summary on Friday that will give us the unemployment rate and nonfarm payrolls numbers for the month of May. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.