Treasury yields are set to end the week sharply lower after a volatile week, fueled by big data releases and a particularly important Fed meeting. Wednesday gave markets both cooler than expected inflation data as well as a more hawkish tone from the latest FOMC statement and Summary of Economic Projections (SEP). In the end, markets took direction from the softer inflation data and largely brushed off the Fed’s more restrictive sentiment. Bond yields plunged and the S&P 500 and Nasdaq both closed at new record highs each day this week.

As expected, the FOMC left the fed funds target range unchanged and made little change to its policy statement. The main language shift in the statement was noting that there has been “modest” progress on inflation where previously the committee had noted a “lack of” progress. The “dot plot,” which reflects the 19 members of the FOMC’s collective expectations on the path of interest rates, showed that the Fed now projects one rate cut this year rather than the three cuts implied in the previous dot plot. It also showed 100bps of cuts in both 2025 and 2026 and the long-run forecast at 2.75%.

The SEP, which is a collection of forecasts for the economy, inflation, and the labor market, was little changed. The Fed maintained its 2024 GDP forecast at 2.1% and its year-end unemployment rate forecast at 4.0% but did increase its unemployment rate forecasts for the next two years by 0.1% to 4.2% and 4.1% respectively. The inflation forecast for 2024 was also raised by 0.2% to 2.6% (headline PCE) and 2.8% (core PCE), suggesting members believe there will be very little further progress on inflation this year as headline PCE is currently 2.7% and core PCE is already 2.8%.

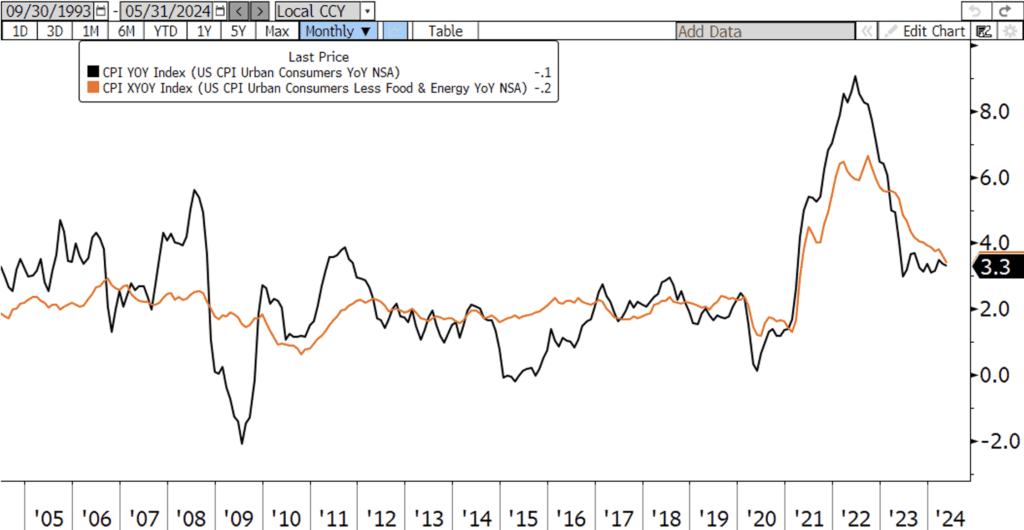

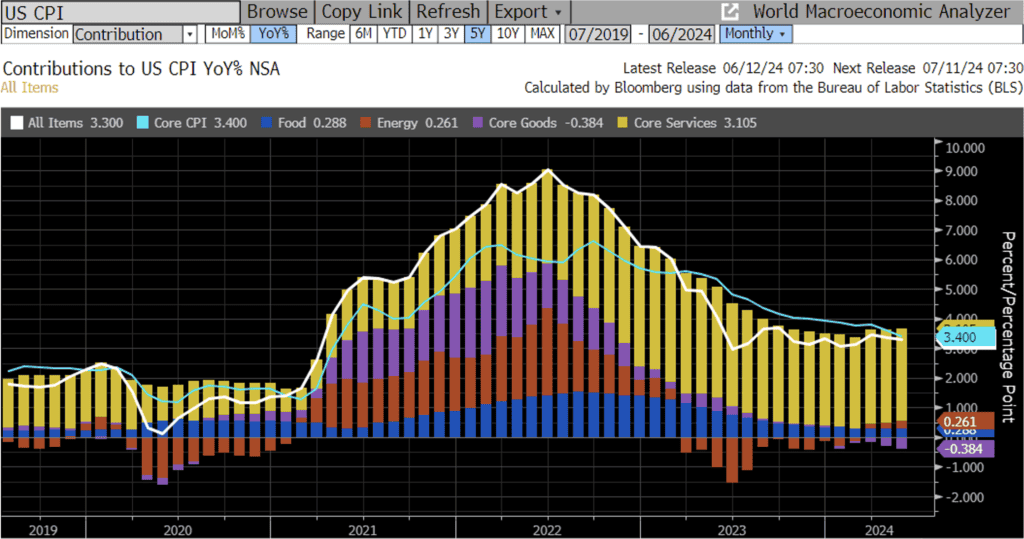

However, this week’s inflation data, released just a few hours before the Fed statement, showed that consumer inflation was unexpectedly flat in May. Forecasts were for the Consumer Price Index (CPI) to increase 0.1% MoM and 3.4% YoY. Instead, the monthly increase was 0.0% and the YoY increase was 3.3%. Core CPI rose just 0.2% (vs. 0.3% forecast) and 3.4% from a year ago (vs. 3.5% forecast), the smallest increase since October 2023. Prices declined for energy, commodities, apparel, and transportation services while the closely watched shelter component rose just 0.4% for the fourth month in a row. Core services, which has been the most “sticky” piece of the inflation puzzle, rose by the smallest amount since September 2021 and the so-called Supercore (core services less housing) actually fell in May for the first time since September 2021.

The CPI data, which showed moderation in all aspects of consumer inflation, seemed to bear greater importance to market participants than the Fed statement. Markets, and many economists, are not buying the Fed’s suggestion that a first rate cut may not come until December. Futures markets are currently pricing in a roughly 65% chance of a quarter point rate cut in September and are fully priced in for a rate cut by the November meeting, which comes just two days after the presidential election.

As of this morning, the 2-year UST yield is down ~20bps to 4.69% WoW, the 5-year UST yield is down 24bps to 4.22%, and the 10-year is down 23bps to 4.21%. Next week will be heavy on the data front, with several readings on housing as well as retail sales, and manufacturing and production data. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.