Although we had a truncated week with the 4th of July holiday, there was plenty of market news on the economic calendar. As of the time of this writing, Treasury yields are down about 15-20bps across the yield curve from where we started on Monday as this week’s slew of economic data shows the economy has begun slowing more rapidly in recent months.

On Wednesday, Payroll processing firm ADP reported that private payrolls rose just 150k in June (est = 165k), the slowest pace since January. ADP tends to come in lower than the official non-farm payrolls report since it does not include government jobs. Adding to the weak employment news, the Department of Labor reported initial weekly jobless claims rose to 238k (est = 235k) last week and continuing claims rose for the ninth consecutive week to 1.858mm (est = 1.84mm), the highest level since late 2021. The sharp rise in continuing claims in recent months is a good indicator that workers are having a much harder time finding a new job after getting laid off and suggests the labor market has deteriorated further in recent weeks.

In another report, the Census Bureau reported that Factory Orders unexpectedly fell 0.5% (est = +0.2%) in May while the prior month was revised lower. The manufacturing sector has been in contraction for the last 2 years and this drop in orders suggests recovery is still lagging. The Institute for Supply Management reported their ISM Services Index unexpectedly plunged to 48.8 (est = 52.7), the lowest level since May 2020 (anything less than 50 indicates the sector is contracting). With the service sector representing nearly 80% of US GDP, the unexpected contraction in the ISM Services Index could potentially be a worrying sign for the health of the economy.

Earlier this morning, the US economy added 206k jobs in June (est = 190k) while the previous two months of job gains were revised lower by 111k. Job gains were led by government (+70k), health care (+49k), social assistance (+34k) and construction (+27k), while retail trade (-9k) and professional & business services (-17k) both saw a loss in jobs. The separate household survey of individuals showed a gain of just 116k jobs and an unexpected increase in the unemployment rate to 4.1% (est = 4.0%). That’s the highest level of unemployment since October 2021 and up 0.7% from the low of 3.4% in January 2023. Every recession in the last 50 years has begun with an increase in unemployment of 0.7% or less so the steady increase in unemployment will be concerning news for the Fed as it decides when and how much to begin cutting interest rates from 23-year highs. Average hourly earnings rose 3.9% from a year ago (est = 3.9%), continuing a trend of weaker wage growth over the last several years that will help bring down inflation towards the Fed’s stated goal of 2%.

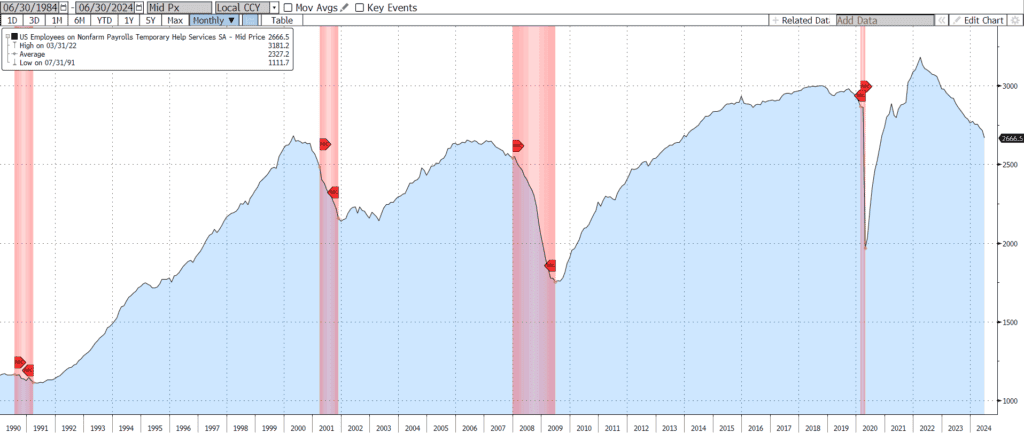

Finally, the labor force participation rate rose to 62.6% (est = 62.6%), but still remains well below pre-pandemic levels of 63.3%. Altogether, this employment report was a mixed bag but will generally be seen as a weak report. Although the headline non-farm payrolls was slightly better than estimated, nearly a third of the gains were government jobs, the prior two months were revised lower by 111k and the household survey showed a much weaker gain of just 116k. Another concerning part of the employment report was the sharp drop in temporary help employment (-49k), the steepest decline in more than 3 years. Historically, a decline in temp employment normally precedes a recession as businesses tend to lay off temp-workers first before moving on to permanent layoffs.

Inflation numbers are on deck for next week as we’ll get a look at CPI and PPI for June. The market will be watching closely to see if the inflation data is able to further validate the softening economic numbers we received this week, or if the Fed will be forced to continue its tight walk between higher inflation and deteriorating employment.

I hope everyone enjoyed celebrating our great nation’s independence yesterday and wish you all a safe holiday weekend.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.