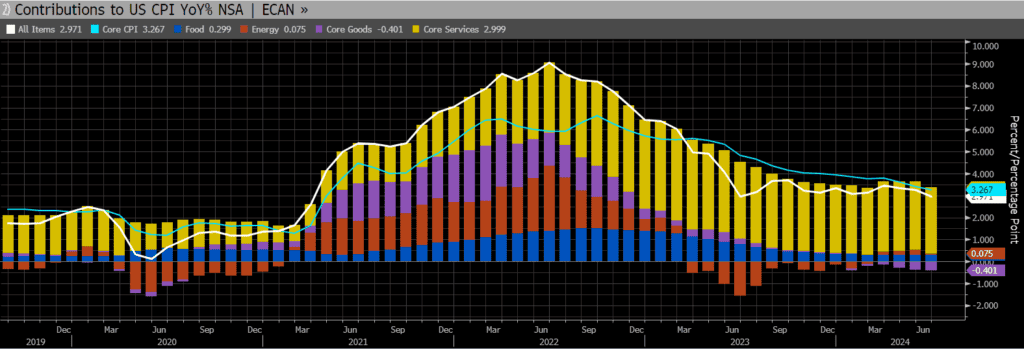

Thursday’s reading of the Consumer Price Index (CPI) showed disinflation is back in the rotation for the first time since the onset of the pandemic. Headline prices actually fell during the month of June amid cheaper gasoline prices and moderating rents, marking the first deflationary print since 2020. Economists had forecast the headline CPI reading to tick up 0.1%. Instead, it fell 0.1%. The annual reading also dipped below 3% for the first time in twelve months, coming in at 2.971% vs. 3.1% survey.

A big drop in weekly jobless claims also hit newswires at the same time yesterday, laying the backdrop for plenty of market volatility. However, the decline in the number of workers seeking weekly jobless benefits can probably be attributed to typical summertime volatility. Nevertheless, the Nasdaq fell almost 2% and the S&P 500 lost almost 1% yesterday while Treasuries rallied and yields fell ~7-11bps across the long end of the curve.

The second straight month of benign consumer price readings was unquestionably good news for the Fed and policymakers were quick to laud the numbers. St Louis Fed President, Alberto Musalem, called June’s CPI report "encouraging", San Francisco Fed President, Mary Daly, said the readings were a “relief, and Chicago Fed President, Austan Goolsbee, called it “profoundly encouraging”.

Futures markets agreed and increased their rate cut bets for the remainder of the year. Traders now have a 25bp rate cut fully priced in by the September meeting and futures markets are showing ~2.5 rate cuts expected in 2024. There is also now discussion circulating of a potential 50bp cut at one of the meetings before the end of the year. Futures markets buying already indicates some traders are betting on a supersized move at the September meeting.

This morning’s readings of producer prices, however, showed the Producer Price Index (PPI) moved higher in June, slightly more than expected. PPI increased 0.2% vs. 0.1% forecast. Compared to a year ago, producer prices were up 2.6%. Nearly all of the monthly increase can be pinned on a jump in margins at wholesalers and retailers. However, separate reports from retailers including Target and Walmart show the merchant giants cutting prices on a range of goods as consumers push back against higher prices.

Next week will give us several readings on the state of the housing market, which continues to struggle amid high interest rates. Numbers are also due on retail sales and US manufacturing and production. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.