Happy Friday everyone, there has been a lot of news to digest this week and even more on the horizon so buckle up for the ride. The stock market has continued to sell off this week, with the S&P 500 and the NASDAQ having their worst single days since 2022 on Wednesday. This sell off has been primarily led by Tesla and Nvidia and the rest of the Magnificent Seven which drove the NASDAQ down over 3%. The bond market has sold off slightly since the start of the week as well with the 10 year treasury dropping below 4.20% as of this writing.

This week we received the first estimate for Q2 GDP growth coming in at 2.8% versus estimates of 2.0% and accelerating from Q1 GDP at 1.4%. The Q2 reading was bolstered by an increase in consumer spending and business inventories continuing to build. Personal Consumption beat expectations, coming in hot at 2.3%, which was an .8% increase from the last quarter. According to the Commerce Department this increase in consumer spending contributed 1.6% to the rise in Q2 GDP. This is the first of three estimates for Q2 GDP, so expect these numbers to be revised in the upcoming weeks.

New Home Sales came in lower than expected, falling 0.6% month over month and marking the fourth straight month of declining sales. This marked a disappointing end to the spring real estate market, which is typically the busiest time of the year for home sales and as homes once again hit record high prices. Home prices continue to rise due to low inventory well below historical norms.

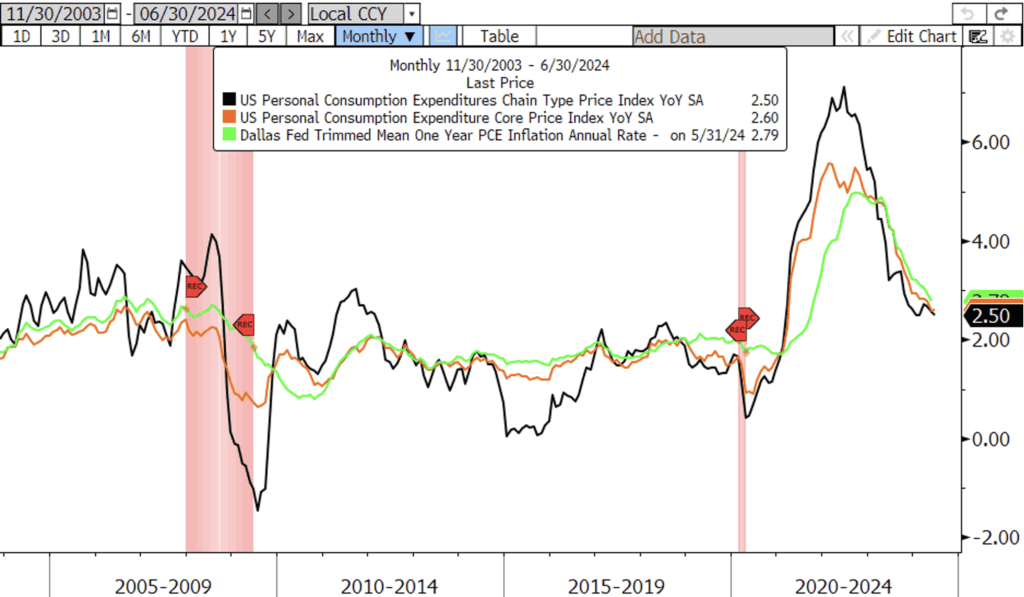

Today we received the ever so important PCE Price Index readings. Headline PCE is the Federal Reserves preferred measure of inflation and plays a pivotal role in policy decisions. PCE rose 0.1% in June and 2.5% from a year ago, both meeting expectations. These readings match the lowest numbers since the pandemic. Core PCE, which excludes food and energy, rose 0.2% in June and 2.6% from a year ago. The Core YOY change was slightly higher than the estimate of 2.5%, however the overall inflation report was in-line with market expectations and continues to show the Fed that inflation is moving towards their goal of 2%.

All of this news leads us into next week, where the FOMC will have their July meeting on Tuesday and Wednesday. The current consensus is that there will be no rate cut at this meeting with the first full cut currently priced in for September. Despite the markets current view, the former President of the New York Fed Bill Dudley released an Op-Ed on Bloomberg calling for rate cuts at next weeks meeting. Dudley makes the argument that a deteriorating labor market is on the horizon and references an economic theory called the Sahm Rule. The Sahm Rule was developed as a signal to show the start of a recession when the three-month moving average of the national unemployment rate rises by 0.50% or more relative to its low during the previous 12 months. Currently we sit at 0.43%, right below that threshold.

We have a lot to look forward to next week outside of the FOMC meeting. On Tuesday we get the JOLTS report, followed by ADP Employment Change on Wednesday, Initial and Continuing Jobless Claims on Thursday and finally the Bureau of Labor Statistics Employment Report on Friday. We also jump full swing into the 2024 Paris Olympics with the opening ceremony tonight, and I for one cannot wait to cheer on the USA as it competes in sports that I only watch ever 4 years. Have a great weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.