Yikes! Markets are tumbling this morning after a much weaker than expected jobs report. Pressure is mounting on the Fed and the question of when the Fed will cut rates has changed to how much they will cut. An unexpected jump in the unemployment rate this morning essentially cements a September rate cut but, given mounting weakness in economic data, many are concerned the Fed may already be too late. As of this morning, futures markets are pricing in four rate cuts before year end and assigning a greater probability of a 50bp cut in September than a 25bp cut.

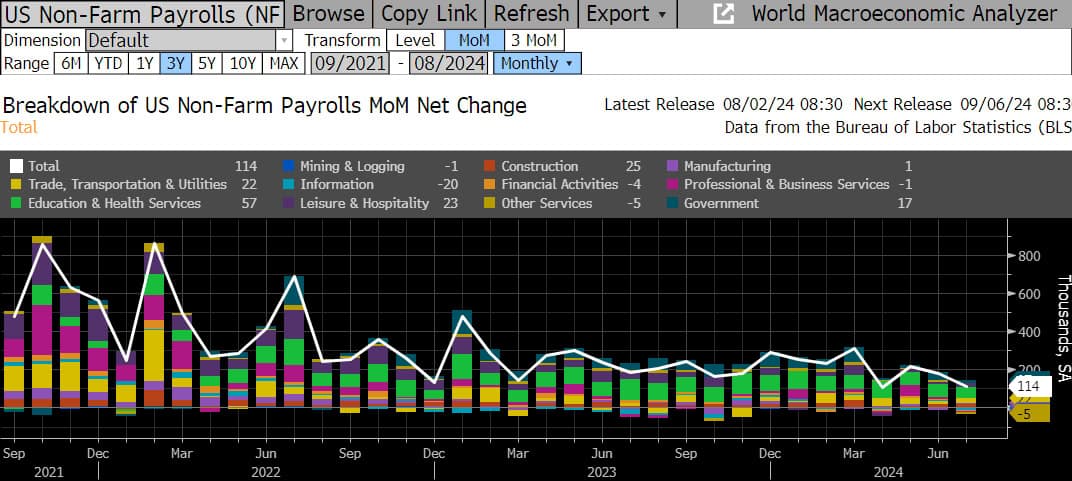

July’s Employment Situation report released this morning showed non-farm payroll job gains came in at 114k, missing forecasts of 185k, and gains in the prior two months were revised lower by 29k. The unemployment rate shot up to 4.3%, missing forecasts of a flat 4.1%. The unemployment rate has now risen 0.9% from the low in January 2023, an increase that has never occurred without a recession. Moreover, the increase officially triggered the ‘Sahm Rule’, which posits a recession is imminent if the 3-month average of the unemployment rate rises more than 0.5% above the lowest level of the 3-month average over the last 12 months. Average hourly earnings also underwhelmed, growing by 3.6% YoY vs. 3.7% forecast and down from 3.8% prior, continuing a steady trend lower towards the pre-pandemic range of 3-3.5%. And finally, a -0.3% contraction in the average weekly hours worked also raised concerns as cuts to hours worked often precede job cuts. The lone bright spot was an increase in the labor force participation rate, which ticked up to 62.7% vs. expectations of a flat 62.6%.

This morning’s employment report came on the heels of a multitude of weak data points this week that have stoked ‘hard landing’ fears, ignited a frenzied rotation from stocks to bonds, and caused bond yields to fall sharply. JOLTS Job Openings data fell shy of expectations as did the ADP Employment Change. Initial jobless claims also unexpectedly jumped to 249k this week, the highest level in almost a year and continuing claims jumped to 1.877mm, the highest level since November of 2021. Also notable was the ISM jobs subindex, which provides insight into employment trends in the manufacturing and services sectors. It plunged to 43.4 from 49.3, which is the weakest ISM employment reading since June 2020 and even lower than it was in September 2008, the month Lehman collapsed and the GSEs were taken into conservatorship.

On Wednesday, the Federal Open Market Committee (FOMC) concluded its two-day policy meeting and left the Fed Funds target range unchanged. The policy statement and Federal Reserve Chair Jerome Powell’s comments in the press conference that followed signaled the first rate cut will likely come in seven weeks’ time. The data that has been released since then all but ensures that outcome but now that the labor market slowdown has materialized with more clarity, many are wondering whether the Fed hasn’t been too slow to act once again.

Bond yields have fallen dramatically and all major stock indices are down sharply as well. Week-over-week the 2-year Treasury yield is down ~48bps to 3.91%, the 5-year is down ~42bps to 3.65%, and the 10-year yield is down ~37bps to 3.83% as of this writing. Next week is light on data but we will hear from a few Fed speakers. Expect volatility to continue as traders grapple with the economic outlook and try to position for the next phase of the rate cycle.

Source: Bloomberg, L.P.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.