Wow, what a week! This week’s volatility really began with last Friday’s weaker than expected employment report that saw the unemployment rate jump to 4.3%, the highest level in nearly 3 years and up 0.9% from the low in January 2023. That increase triggered the so-called Sahm Rule, which has a 100% accuracy of predicting recession since WWII. Wall street reacted by pricing in a 50bp rate cut in September and 100bp of cuts by year-end as there was a growing consensus that the Fed was behind the curve and needed to aggressively ease monetary policy soon. And that led to Monday’s action which saw the Japanese Nikkei crash 12% (equivalent to 4700 points on the Dow!) as traders unwound something called the “Yen Carry Trade.” The Yen Carry Trade is when traders borrow money in Japan at near zero interest rates and then use those funds to buy Japanese stocks or convert those funds from Yen to another currency like Dollars and then buy assets like US tech stocks or Bitcoin. As the Fed hiked rates from 2022-23 and the Bank of Japan left rates below zero, the trade worked perfectly as those borrowing costs remained low, the assets rose in value and the Yen depreciated. But then those tech stocks started to fall over the last month, the Bank of Japan raised interest rates above zero for the first time in a decade and the Yen appreciated as traders priced in big rate cuts from the Fed. Suddenly a very profitable trade was massively unprofitable, and traders rushed to unwind the carry trade, causing stocks to plunge in value and bonds to surge as investors sought safe havens. At one point on Monday, the 2yr yield fell to 3.65%, down 135bp since the end of May and the 10yr hit 3.66%. But once the worst of the Yen Carry Trade unwind was finished, the Nikkei and US stocks rebounded for the rest of the week and yields rose with the 2yr up 15bp to 4.03% and the 10yr up 14bp to 3.93%. The crisis has abated for now, but there is still believed to be trillions of dollars’ worth of Yen Carry Trades remaining, so the risk of more volatility in the future remains.

There was a lack of data this week, but next week is a full calendar. The focus will be on Wednesday’s CPI report to see whether inflation continues on its downward trajectory which would allow the Fed to deliver the big rate cuts the market now expect. We will also get retail sales, PPI, jobless claims, industrial production, housing starts, building permits, and University of Michigan sentiment so this could be another volatile week. Stay tuned!

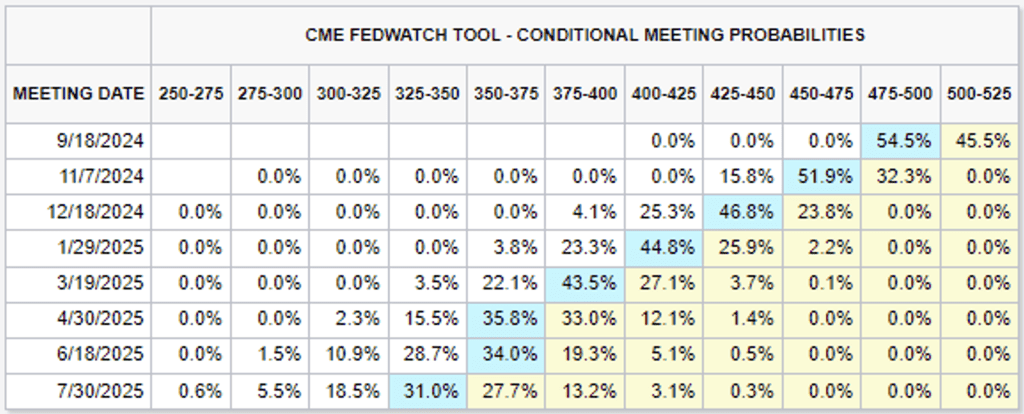

Fed Funds Futures Rate Cut Probabilities

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.