We almost made it through the week with fairly benign volatility until a surprise retail sales print on Thursday shifted momentum again. But markets are starting off calmer this morning and Treasury yields are not far from where they were on Monday. The 2-year is up about 9bps to ~4.11%. the 5-year is up ~5bps to 3.79% but the 10-year is basically flat as is the <1-year part of the curve.

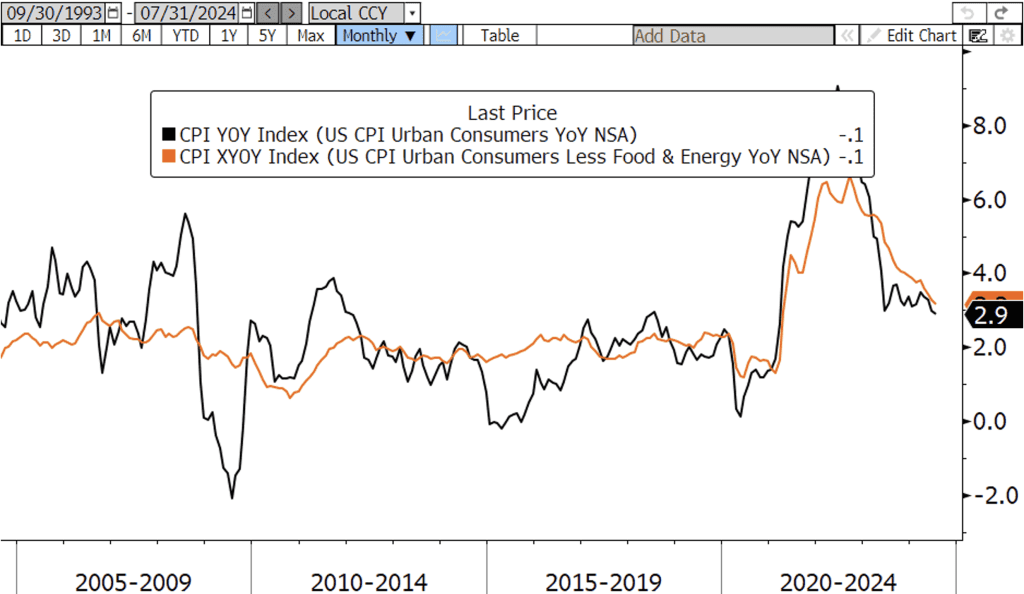

The focus of the week was on Wednesday’s latest inflation reading, which was right in line with expectations, and showed the annualized rates of both headline CPI (Consumer Price Index) and core CPI easing for the fourth consecutive month in July. Headline CPI rose 0.2% in July (est = 0.2%) and 2.9% from a year ago (est = 3.0%) while Core CPI rose 0.2% in July (est = 0.2%) and 3.2% from a year ago (est = 3.2%). There were price declines in commodities, new and used vehicles, apparel and medical care services while food, transportation services, and shelter prices rose. Importantly, the 3-month annualized rate of Core CPI, which the Fed considers a better gauge of underlying inflation trends, fell to 1.6%, well below the its 2% target.

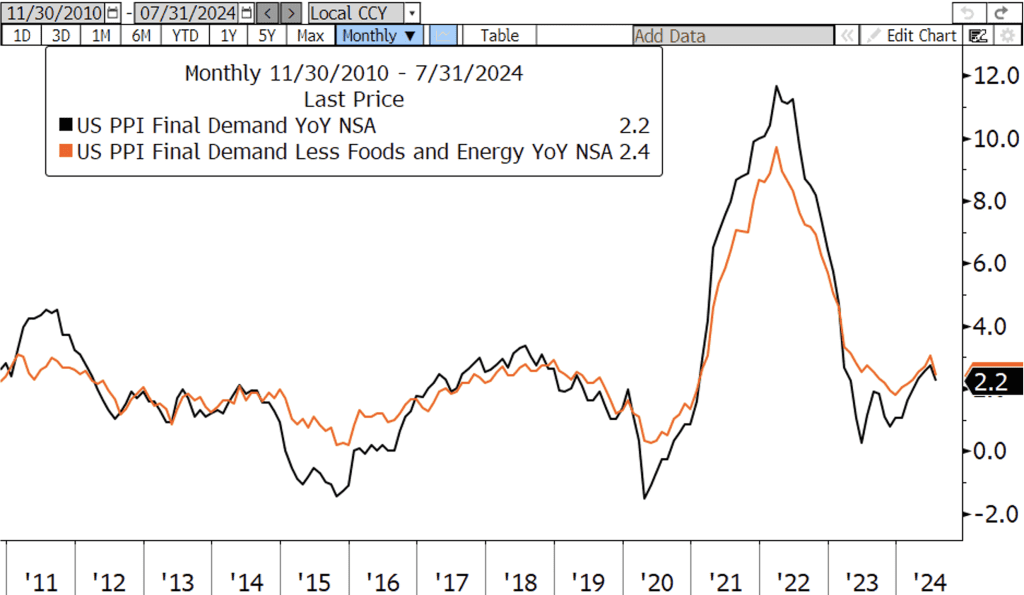

Wednesday’s CPI report also came on the heels of a softer than expected wholesale inflation print on Tuesday, which really clears the deck for the Fed to start easing next month. The Producer Price Index (PPI) rose 0.1% (est = 0.2%) in June and 2.2% from a year ago (est = 2.3%) while Core PPI was unchanged in June (est = 0.2%) and up 2.4% from a year ago (est = 2.6%). Wholesale inflation tends to lead consumer inflation, so this report came as a welcome sign that inflation is continuing to trend towards the Fed’s target.

Thursday’s data, however, showed some signs that perhaps the economy may not be slowing as fast as some traders had expected. Initial jobless claims for the week fell more than forecast to 227k last week (est = 235k) and continuing claims fell to 1.864mm (est = 1.870mm). Retail sales, which makes up about 40% of overall consumption, the largest component of GDP, are an important measure of the health of the economy as American’s who feel confident about their job and earnings potential tend to spend more. July’s data showed retail sales rising 1%, well above estimates of 0.4%.

The ongoing resilience of consumer spending has eased recession fears and reduced the odds that markets have placed on a larger (half-point) rate cut at the Fed’s meeting next month. Fed funds futures are now pricing in less than a quarter percent chance of a 50bp cut in September and just shy of 100bps of cuts before year end. At the start of the week, there had been more than 100bps of puts priced in for 2024 and a great chance of an initial 50bp cut in September.

However, it does appear that most Fed officials are prepared to start easing next month. St. Louis Fed President, Alberto Musalem, said on Thursday that, "It now appears the balance of risks on inflation and unemployment has shifted… the time may be nearing when an adjustment to moderately restrictive policy may be appropriate." Atlanta Fed President, Raphael Bostic, also told Thursday's Financial Times that he was open to a rate cut in September and added the Fed could not "afford to be late" to ease policy.

The Fed's annual Jackson Hole symposium starts late next week and should provide further insight into the central bank's current thinking. We will also get meeting minutes from the Fed’s Open Market Committee meeting last month on Wednesday. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.