Treasury yields across the curve remained stable this week and are currently trading within a couple basis points of where we began on Monday with the 10yr sitting at 3.86%. There was little “market-moving” data on the whole this week, but we did get a look at the Fed’s preferred measure of inflation, the US Personal Consumption Expenditure Index or PCE.

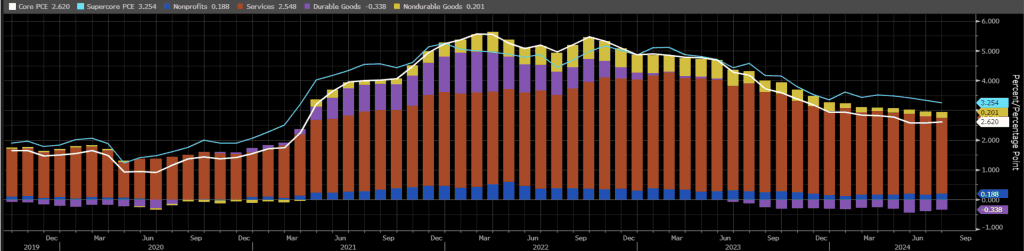

Headline PCE rose 0.2% (est = 0.2%) and 2.5% from a year ago (est = 2.5%), right in line with analysts’ expectations. Core PCE, which allows us to get a closer look at underlying inflation trends by excluding more volatile categories like Food and Energy, rose just 0.2% in July (est = 0.2%) and 2.6% from a year ago (est = 2.7%). Furthermore, the closely watched Supercore PCE (core services less housing) fell to 3.25%, the lowest level since March 2021. Even more importantly, the 3-month annualized increase in Core PCE fell to just 1.7%, well below the Fed’s target of 2% and suggests the Fed should have enough confidence that inflation is under control and they can begin cutting interest rates next month.

With the price stability (inflation) component of the Fed’s Dual Mandate appearing to be tamed, markets have shifted their attention to the other side of the coin, maximum employment. As the Fed has been primarily focused sealing off inflation, another leak has sprung. Unemployment has risen to 4.3% and above the Fed’s longer-term projections of 4% they set out when they first began their rate hikes. The Fed is acutely aware of this increase and just last week Chairman Powell said, “We do not seek or welcome further cooling in labor market conditions.” Much of the market volatility over the last couple of years has come from inflation data, but given Chairman Powell’s comments and the current economic backdrop, portfolio managers should anticipate that employment data may be the larger driver of market volatility going forward.

The data has so far complied with the Fed which will give them confidence to proceed with their first rate cut on September 18th. We’ll get one more employment report next Friday, which is currently expected to show the economy added 164k jobs in July and the unemployment rate fell to 4.2%. We’ll also get one more look at inflation the following week with CPI. The stage is set for the Fed to come off of the peak rate that was set exactly 400 days ago, the bigger question now is how quickly they will get to their longer-term projections of a sub 3% rate on Fed Funds. The soft-landing scenario will likely be consistent and methodical over time, but additional deterioration in employment would likely lead to more expedient rate cuts. As of today, Fed funds futures are currently pricing a 100% chance of a Fed rate cut on September 18, with about a 30% chance of a 50bp cut and a 70% chance of a 25bp cut.

Hope everyone has a great holiday weekend! P.S. Good luck to your favorite college football team, this will be the year they finally go undefeated.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.