The question on everyone’s mind lately has been “When will the Fed cut rates?” This question seems to have been answered over the last month or so, and now the next question is “Will the Fed cut rates 25bp or 50bps at their September meeting?” We are now less than two weeks away from officially finding out!

Treasuries are rallying this morning pushing prices up and yields down as the economy added a less than expected 142k non-farm payrolls in August (est = 165k), the last 2 months were revised lower by 86k. The unemployment rate fell 0.1% to 4.2% (est = 4.2%). Some of the biggest job gains last month came in health care (+44.1k), leisure and hospitality (+46k) and construction (+34k). The downward revisions of 86k to the prior two months' payroll figures is generally pushing the overall consensus that this was a weaker jobs report as it adds to the idea that the labor market is softer than the headline data suggests. Downward jobs revisions have become the new normal this year. 11 out of the 15 jobs reports have now been revised lower. The June jobs report has now been revised lower two times, which has been concerning for a cooling labor market.

The Fed has been clear in communicating that the labor market is slowing, and Chairman Jerome Powell stated a couple of weeks ago that “we do not seek or welcome further cooling in labor market conditions.” Earlier this morning, New York Fed President John Williams spoke in New York and was quoted saying "it is now appropriate to cut interest rates." He also stated, “with the economy now in equipoise and inflation on a path to 2%, it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate.”

The Fed funds futures market have been all over the place this morning, but as of 11:00am CST, they are now calculating a stronger probability (77% chance) of a 25-basis point rate cut and a 23% chance of a 50-basis point rate cut at the upcoming September 18th meeting.

Earlier this week, the Job Opening and Labor Turnover Survey (JOLTS) was released. Job openings slumped to their lowest level in 3.5 years in July, another sign of slack in the labor market. The amount of available job positions fell to 7.67 million (est = 8.1 million) for the month, off 237k from June’s downwardly revised number and the lowest level since January 2021.

Next Wednesday, we will get the August release of the Consumer Price Index (CPI). This will be one of the last key data points before the Fed’s September 18th Meeting the following week. Headline CPI is expected to increase 0.2% on a month-over-month calculation and a 2.6% increase year-over-year. Core CPI is expected to increase 0.2% month-over-month and 3.2% year-over-year.

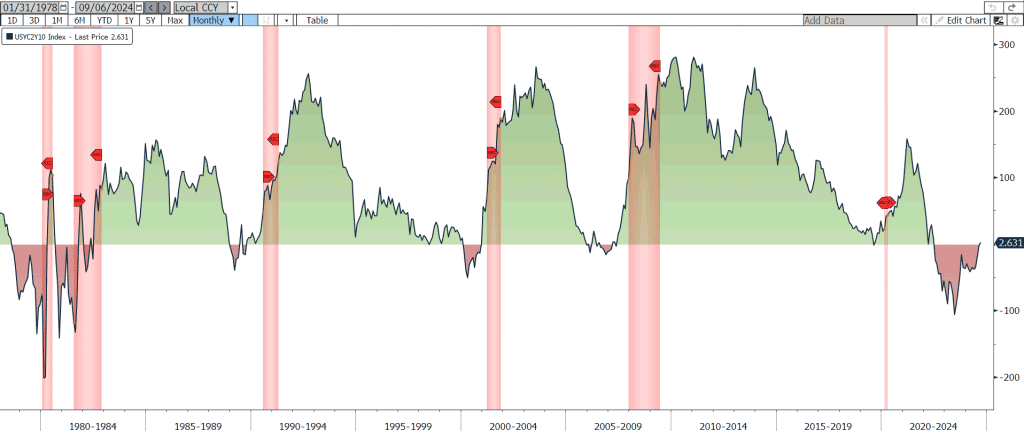

A quick check in on the markets before I conclude this week’s Baker Market Update! Stocks are off this morning as the Dow Jones Industrial Average is currently down 361 points. The Treasury markets continue to rally with the 2-Year Treasury yield sitting at 3.68% and the 10-Year Treasury yield sitting slightly higher at 3.70%. Yes, you read that correctly, the yield curve is slightly un-inverted in the relationships between the 10- and 2-year Treasury yield. This week’s un-inversion of the yield curve marks an end to the longest curve inversion in US history. Historically, the curve un-inversion has signaled the beginning of a recession. Stay tuned and enjoy the weekend!

Spread Between the 10-Year and 2-Year Treasury (1978 to Present)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.