This week we received a litany of important data on inflation, consumer credit and consumer sentiment just to name a few. Yet it feels somewhat muted as all eyes look to the FOMC meeting next week and ultimately what J Powell and Co’s decision will be regarding the target Federal Funds Rate. The stock market seems to have slipped out of the slump from the beginning of September, with both the S&P 500 and Dow Jones Industrial Average posting strong weekly gains. The S&P 500 has seen a 3.14% gain over the last 5 days and the Dow Jones has seen gains of just over 2%. Bond yields have slightly fallen this week with the 10 year US Treasury moving down almost 4 basis points to 3.66% and the 2 year US Treasury falling 7 basis points to 3.59%. Yes, you read that correctly! The spread between the 2 year and 10 year US Treasuries continues to keep a positive slope and currently sits at 7 basis points.

Let’s dig into some of the data that came out this week, starting with the consumer credit reports for the month of July we received on Monday. Expectations were for consumer credit outstanding to jump from $8.9 billion up to $10.4 billion. The reading missed the mark just slightly, if slightly means by a huge margin, coming in at $25.4 billion in outstanding consumer credit. Already stretched consumers continue to spend on credit, and as credit card and auto delinquencies continue to rise, we must ask ourselves “Where is the breaking point?”. Ally Financial, one of the largest auto lenders and banks in the United States, saw a sharp decline in its stock price on Tuesday after their CFO warned of deteriorating financial status of borrowers and rising delinquencies. Is Ally a one off situation, or a glimpse of what is on the horizon?

This week we also received updated readings on two different measures of inflation, Consumer Price Index (CPI) and Producer Price Index (PPI). Headline CPI rose 0.2% in August and 2.5% year over year which met expectations. Core CPI came in slightly hotter than expected with a rise of 0.3% versus estimates of 0.2% for the month of August. We saw price increases in food, shelter and transportation services. Shelter, which makes up almost half of core CPI, was the largest contributor to the monthly increase and rose at its fastest pace since January. PPI followed a similar trend to Core CPI, rising to 0.3% in August versus estimates of 0.2%.

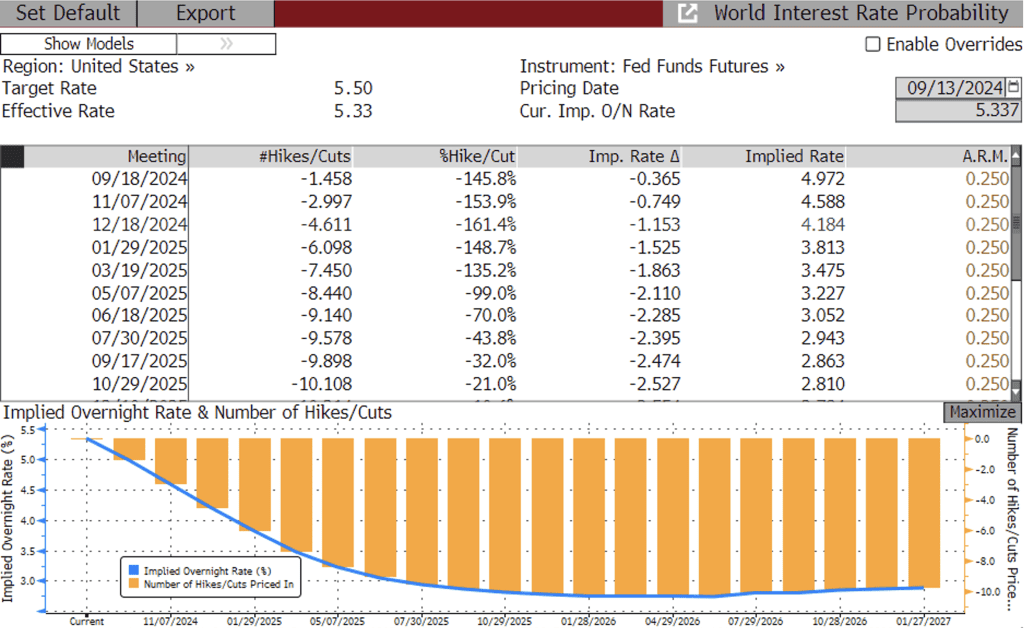

Last but certainly not least, we must discuss the Fed and the expectations for next week’s FOMC meeting. It seems to be a forgone conclusion that the Fed will cut rates next week. Now the questions have turned from “When will they cut?” to “How big will the cut be?”. The Fed Funds Futures market is split between a 25 basis point cut and a 50 basis point cut, with the current implied rate cut at 36 basis points. The odds of a 50 basis point cut rose from 15% to 45% overnight with former Federal Reserve Bank of New York President William Dudley stating, “I think there is a strong case for 50” and “I know what I’d be pushing for.” With a mixed bag of data for inflation and employment it is hard to gauge exactly how aggressive the Fed will cut next week. Will they start small and ease into the cuts on the back of hotter inflation data? Or has the labor market deteriorated enough to warrant a larger cut? Either way, it seems like the party at the peak is over with the Fed Funds Future market pricing in over 9 rate cuts (225 basis points) by this time next year.

Along with the FOMC rate decisions, we will also receive an updated Dot Plot and expectations for market conditions. Tune in next Wednesday to see where the Fed decides to go! Have a great weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.