Is it ridiculous of me to say that the anticipation leading up to this weeks FOMC meeting had me feeling like a kid on Christmas Eve? You knew something was coming, in this case a rate cut, but you just did not quite know what that something would be. Would the Fed deliver a 25 basis point cut on the back of a strong economy and solid retail sales we saw earlier this week? Or would they come in swinging and start off strong with a 50 basis point cut to avoid further deterioration in the labor market? Ultimately Chairman Powell came down the chimney at Jackson Hole and gave the US Economy a present in the form of a 50 basis point cut. Prior to the decision the market was split on which way the Fed would go. In fact, even the FOMC themselves were split. Michelle Bowman became the first Fed Governor since 2005 to dissent, instead favoring a 25 basis point cut. Let’s take a look into Chairman Powell’s comments following the 50 basis point decision, and what their projections are going forward.

Chairman Powell stated that “This decision reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 percent.” Powell continues his comments with notes on the strength of the economy, rising GDP, resilient consumer spending and improving housing supply. The decision made on Wednesday was based upon the recent movement in the labor market and to avoid a further deterioration of that market. The current unemployment rate currently sits at 4.2%, an increase of 0.8% from the low of 3.4% we saw in April of 2023. The FOMC is aware that a large cut in its’ target rate has the potential to hinder, or even reverse, the progress made on inflation, but Powell also states that “reducing restraint too slowly could unduly weaken economic activity and employment”. The fight to lower inflation is not over just yet, but the upside risks have started to wane as the downside risks to employment ramp up.

Initial stock market reactions were mixed on Wednesday. The S&P 500 and Dow Jones Industrial Average both rose on the news, before ending the day in the red. This quickly shifted on Thursday and both indexes have seen gains of over 1% this past week with the Dow closing above 42,000 for the first time. Treasury yields also saw an increase this week. The 10 year US Treasury has risen 14 basis points from Monday, currently sitting at 3.75%. The 2 year US Treasury also rose by 8 basis points to 3.63%. The higher movement in Treasury yields be attributed to the FOMC’s long term projections for their terminal rate and Powell’s comments on the economy.

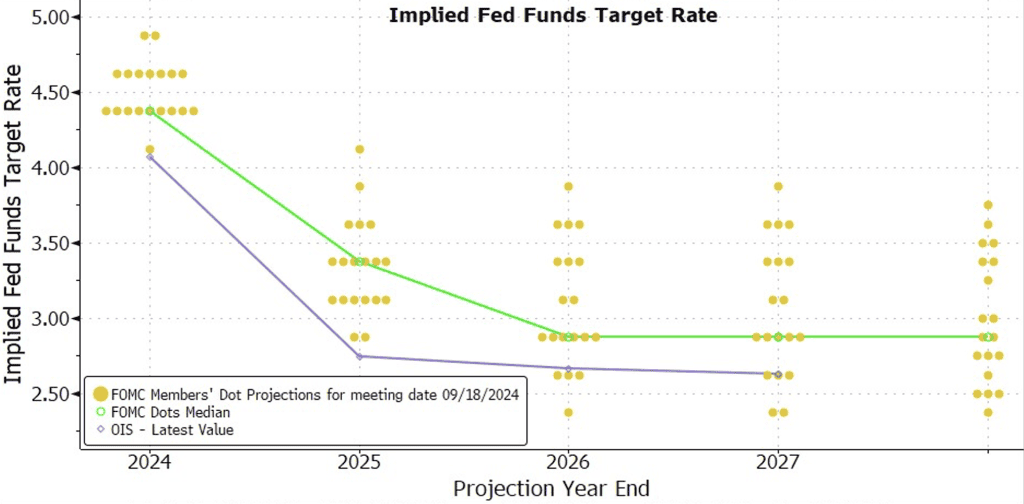

The Fed’s dot plot, which is a chart that records individual Fed officials’ projections on short term rates over time, was updated on Wednesday. In June, the dot plot laid out 25 basis points worth of cuts for 2024. With this week’s meeting, we have now exceeded that figure. The current dot plot shows 50 basis points worth of cuts to end the year, settling at a target rate of 4.375%. Over the long term the terminal rate is slated to fall to 2.875%. This is the 3rd release in a row where the long term rate has increased from the previous report. The Fed Funds Futures market is currently pricing in between 2 and 3 rate cuts to end the year and another 5 cuts by the end of 2025.

Next week we will get an updated reading on PCE, Durable Goods, GDP and Consumer Sentiment. There is also quite a bit of Fed Speak over the next week that could provide valuable insight into this week’s decision to cut 50 basis points. Dissenting Fed Governor Michelle Bowman is slated to speak 3 times over the next week, and I for one am very keen to get her take on the future of the US economy and labor market. Have a great weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President, Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.