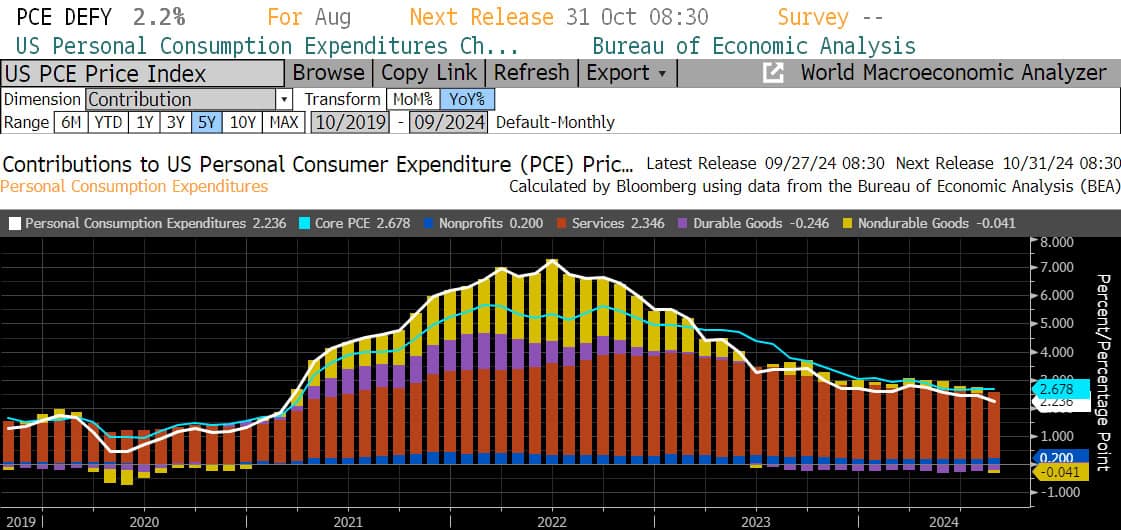

Good news this morning on the inflation front to end the last full week of the quarter. The Fed’s preferred measure of inflation, the Personal Consumption Expenditure (PCE) price index, rose less than expected in August. The headline measure fell to 2.2% year over year, below estimates of 2.3%. Core PCE, which excludes food and energy, printed in line with forecasts at 2.7% YoY. Both measures rose just 0.1% MoM.

Markets have taken the readings as justification for the Fed to stay the course on rate cuts in the months ahead and reignited the debate over how big the next cuts should be. The Fed opted for an outsized 50bp cut last week to start the easing cycle and telegraphed 50bps more cuts to come before year-end. That implies two 25bp cuts at each of the Fed’s last two meetings of the year if policymakers were to move gradually. Futures markets, however, have ~75bps of cuts priced in through December and are split over whether the next cut in November will be 25 or 50bps, with the 50bps outcome having the slight edge.

Details of the report showed inflation moderating broadly across sectors. Services prices, excluding housing and energy rose 0.2% for the second month in a row, and goods prices, excluding food and energy, declined 0.2%, the biggest drop in three months. The personal income and spending numbers also posted downside surprises, underscoring a gradually cooling economy. Personal income rose just 0.2% MoM in August, half the 0.4% expected. Personal spending underwhelmed as well, rising 0.2% MoM vs. 0.3% expected, suggesting that as income growth cools, consumers are becoming more discerning in their spending habits.

Markets are rallying across the board this morning in the wake of this morning’s PCE report which comes on the heels of yesterday’s strong GDP and initial jobless claims readings that showed continued resilience in the economy. The third and final reading of US GDP showed that the economy grew at a 3.0% annual rate in the second quarter, a notch above market expectations of 2.9%. Initial jobless claims came in at 218k, shy of estimates of 223k, suggesting that even if hiring is slowing, those that have jobs are holding onto them.

Stocks are surfing new highs this morning with both the S&P 500 and Dow trading at record levels. Treasury prices are also up this morning though yields are mostly flat week over week. Next week, we will have a fresh round of jobs data capped off with the latest unemployment report on Friday. These numbers may be especially impactful as the Fed is increasingly emphasizing the maximum employment side of its dual mandate. The committee will have just one more employment report after next week’s before meeting again on November 6-7 to decide its next policy move. Hope everyone has a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.