Bond yields are sharply higher this morning on news that US hiring toped all estimates in the month of September and the odds of another big 50bp Fed rate cut have dropped significantly. The report was universally strong with better-than-expected payrolls gains, positive revisions to prior months’ gains, a lower unemployment rate, and higher than expected wage growth.

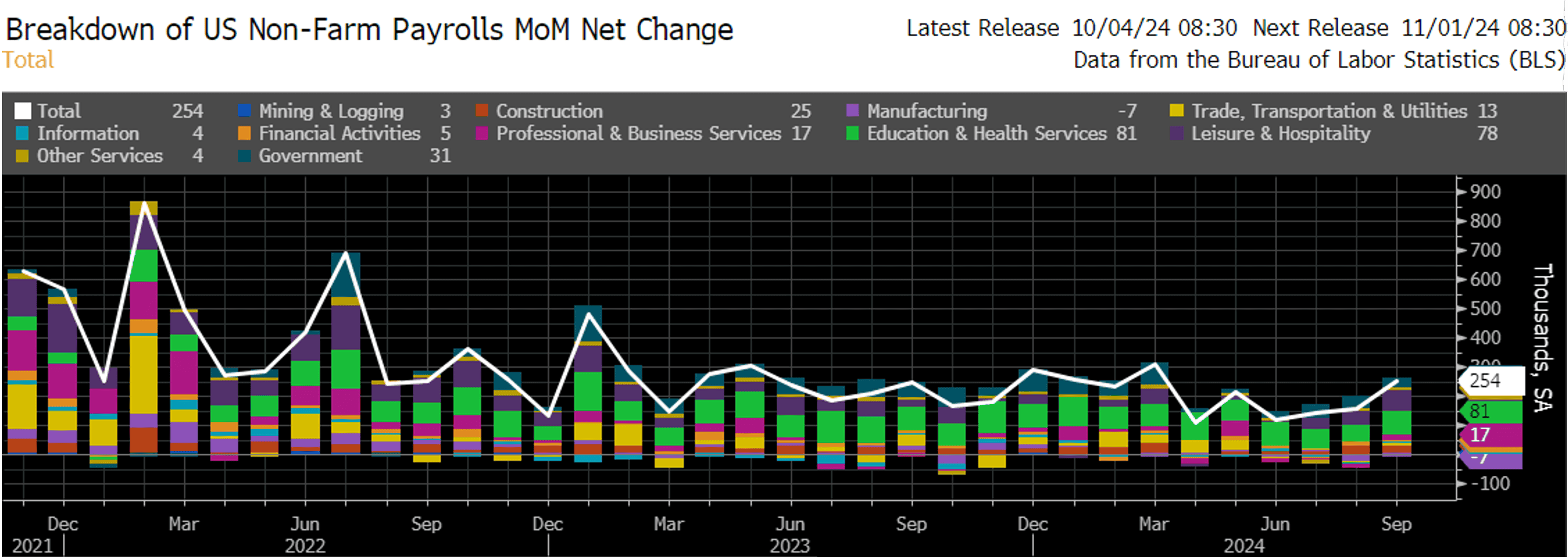

Nonfarm payrolls increased 254k in September (vs. 150k estimate), the most in six months. The prior two months’ gains were also revised higher in contrast to the overwhelming trend of the last several reports that saw downward revisions in 11 out of the last 15 nonfarm payrolls prints. The unemployment rate unexpectedly fell to 4.1% (vs. 4.2% est.) and average hourly earnings increased 0.4% MoM (vs. 0.3% est.), up 4.0% YoY (vs. 3.8% est.).

This week’s earlier employment data also showed that demand for workers remains solid and layoffs remain low. Thursday’s ADP data showed job growth surprised to the upside with 143k private employment gains (vs. 125k est.). On Tuesday, JOLTS data showed job openings jumped 329k to 8.04 million (vs. 7.69mm est.) in August, though that only partially offsets the declines over the prior two months. Layoffs also declined 105k following a 153k increase in July.

This was undoubtedly welcome news for the Fed who has been concerned about further deterioration in the labor market. Chairman Powell reaffirmed this week that shielding the labor market from erosion was part of the reason the Fed opted to kick off its easing cycle with an outsized 50bp cut. Powell also said that policymakers believe no further cooling is needed to bring inflation down to the Fed’s 2% target.

Futures traders slashed their bets on the pace of future Fed cuts following this morning's release. The odds of a half-point rate cut in November were virtually wiped out and futures contracts now show just a 5.5% chance of that occurring at the next meeting. Markets now show ~58bps of cuts expected for the last two meetings of the year combined.

The 2-year Treasury rate, which is especially sensitive to Fed policy, initially popped as much as 17bps to 3.87% this morning and is just shy of 3.86% as of this writing. The 10-year note backed up as much as 12bps to 3.96% and is still near peak at 3.95% at the time of this writing.

Markets continue to weigh signs of persistent growth in the economy with the need for growth to come at a pace soft enough to sustain disinflation. Fortunately, the economy appears to have dodged a potential inflationary bullet late yesterday. U.S. East Coast and Gulf Coast ports began reopening, quashing the threat that ports strikes could drive retail prices higher in the coming months. However, tensions remain in the middle east, threatening energy prices and geopolitical stability. Add a looming presidential election just weeks away and there is plenty of fuel for volatility.

Next week brings key consumer and producer inflation readings, FOMC minutes, and no fewer than 20 Fed speakers. As well as the esteemed OU-TX game for all who celebrate! Hope everyone has a wonderful weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.