The last full week of October appears set to end relatively quietly after a somewhat volatile week. The anxious pre-election climb in Treasury yields that characterized the week has settled back some this Friday morning. The benchmark 10-year yield is now below 4.20% after reaching a three-month high on Wednesday.

Bond investors are reassessing the Fed rate-cut outlook against the backdrop of strong economic data and the upcoming presidential election that is now just 11 days away. Traders are positioning for a potential Republican sweep of Congress and the Presidency and weighing the potential implications for the U.S. budget deficit as well as domestic inflation and oversees growth given the proposed tax cut and tariff plans. That helped propel yields higher this week. The 10-year rose more than 16bps by mid-week and is now hovering around 12bps higher week-over-week.

Several Fed speakers this week have also suggested a more cautious approach may lie ahead for rate cuts. The next Fed meeting falls on November 7th, two days after the presidential election. Market participants are currently pricing in a 25-basis point cut for the November meeting with near 96% probability.

The Fed’s "Beige Book" survey came out this week, showing U.S. economic activity was flat in most parts of the U.S. since early September. “On balance, economic activity was little changed in nearly all districts since early September, though two districts reported modest growth,” the report said. “Reports on consumer spending were mixed, with some districts noting shifts in the composition of purchases, mostly toward less expensive alternatives.”

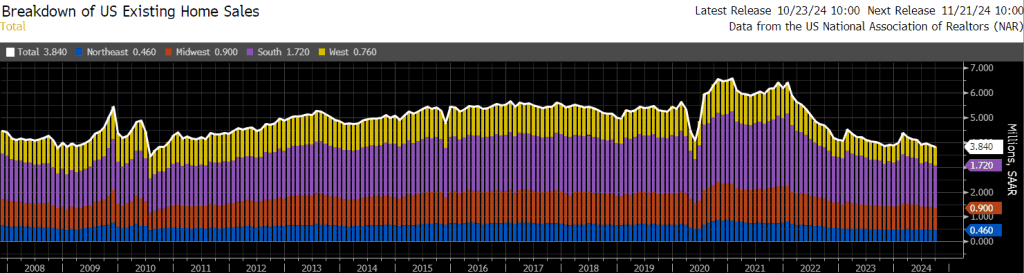

Existing Home Sales came in shy of expectations this week, slipping -1.0% MoM to a 3.84 million annualized rate. The data set a low not seen since October 2010 in the wake of the Global Financial Crisis. Median home prices were down as well but affordability ratios remain extremely constrained.

Also, one chilly reminder that we have both jobs week and Halloween coming next week so plenty of trick or treat in store for all! Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.