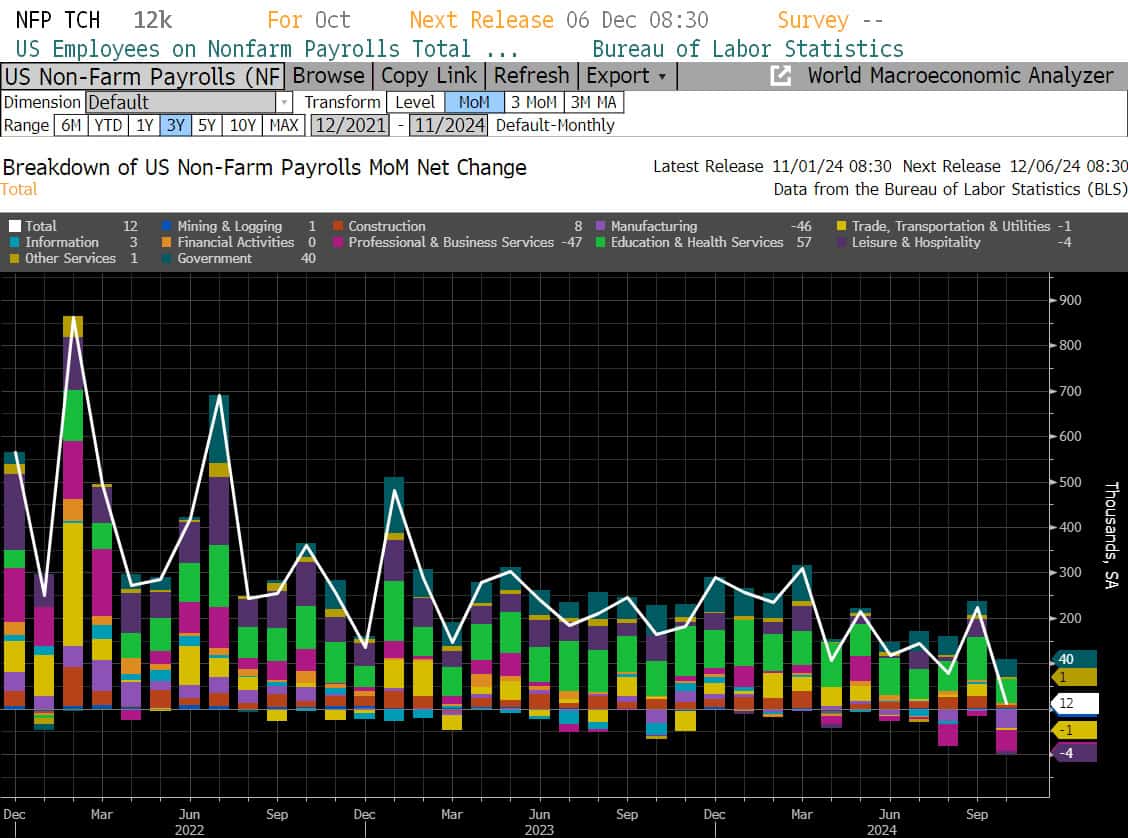

We end this dizzying, event-packed week with news this morning that the US economy added just 12k jobs in October, well short of the 100k gains forecast. That represents the smallest nonfarm payrolls growth in nearly four years. It is important to note that disruptions from hurricanes and strikes by aerospace factory workers are being blamed at least in part for denting US job growth. However, the significant variance vs. expectations and the large downward revision of the two prior months are quite notable. The previously released payrolls numbers for August and September were revised lower by a combined 112k.

Also notable in the nonfarm payrolls numbers was the 49k decline in temporary help services. Temporary services employment is viewed as a leading indicator for broader employment trends as companies tend to layoff temporary workers before cutting permanent, full-time workers.

The unemployment rate held steady at 4.1%, though the household survey, from which the unemployment rate is calculated, showed a loss of 368k jobs. The establishment survey (nonfarm payrolls) and the household survey (unemployment rate) differ in several key ways that can often lead to discrepancies between the two data sets.

Bond yields fell sharply after the release with the 2-year yield down 10bp to 4.08% and the 10-yeaer down 5bp to 4.23%. However, the print did little to change Fed rate cut expectations with the market still pricing in a near 100% chance of a 25bp cut next week and around 80% chance of another 25bp cut in December.

To round out the labor market data this week, we saw JOLTS job openings (a measure of labor demand) fall short of expectations in the month of September to 7.44 million vs. 8 million expected by economists. That marks the lowest level since early 2021 as the labor market continues to slow. However, the ADP employment report, which offers insight into the private sector labor market, showed hiring accelerated by the most in over a year and exceeded survey estimates (+233k jobs vs. +111k expected).

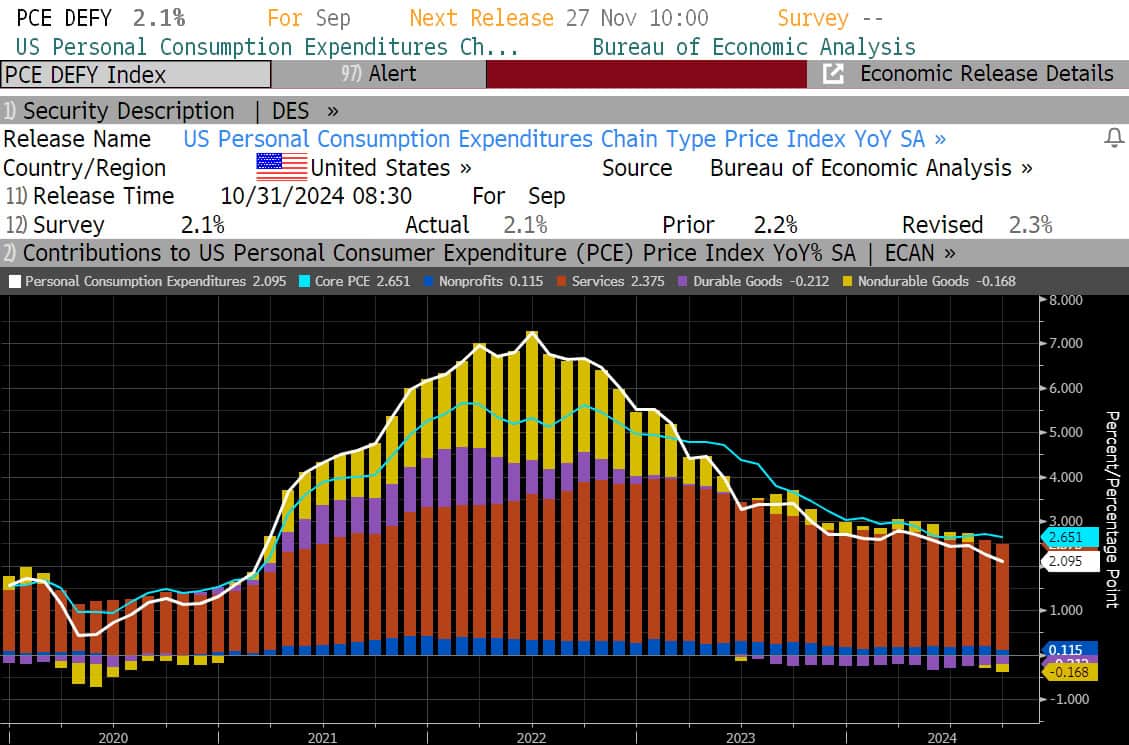

Thursday’s Halloween edition of the Fed’s favored inflation reading, Personal Consumption Expenditures (PCE), was mercifully un-ghoulish. The headline PCE deflator came in as expected at +0.2% MoM, which brought the YoY inflation rate to +2.1% from +2.3% in August. The core (ex. food & energy) index, which carries more significance for the Fed, rose in line with expectations at +0.3% MoM, but that failed to lower the YoY inflation rate which held steady at +2.7% YoY, which is somewhat disappointing, but the fundamental inflation trend is still heading lower.

Finally, we saw a slight headline miss on third-quarter GDP this week with economic activity coming in at 2.8% growth vs. 2.9% survey. Though the pace was still robust, it marks a slight downturn from the 3.0% growth observed in the second quarter. The third quarter’s growth was powered by an acceleration of household purchases and increased spending on defense by the federal government.

Unfortunately, there is no reprieve from the deluge of market moving events next week. We have both a presidential election as well as the next FOMC meeting and subsequent rate decision next week. We will also be celebrating The Baker Group’s 45th Anniversary with a seminar in Scottsdale, AZ to round out the week’s exciting events. We look forward to celebrating with the clients and friends who are able to attend and hopefully to provide some valuable insight into the week’s events. Have a great weekend!

Source: Bloomberg, L.P.

Source: Bloomberg, L.P.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.