It was a short week for economic news due to the Veterans Day holiday on Monday. A special thank you to all the Veterans who have served our great country and afford us the freedoms we all hold dear.

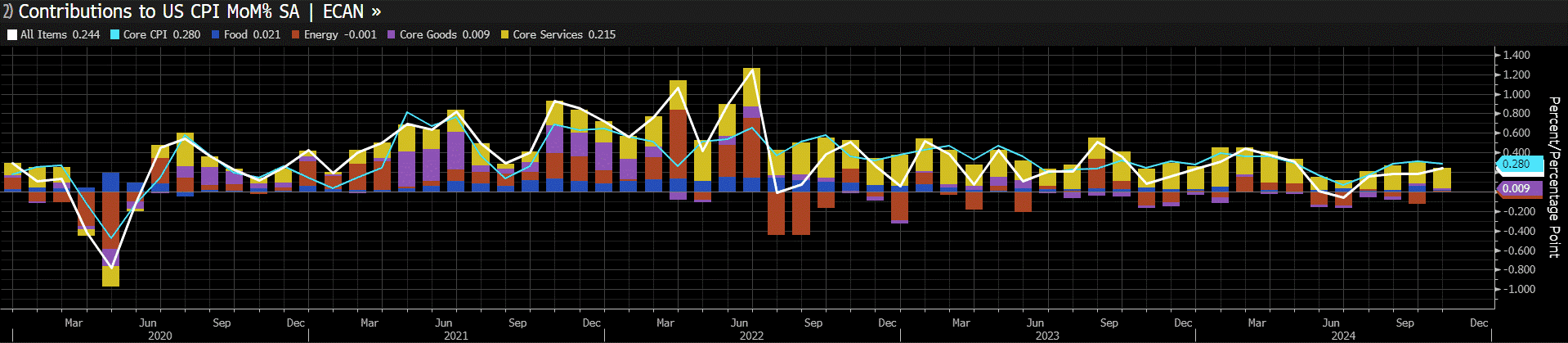

Inflation was the big news for the week. On Wednesday, the Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) report for October. The report showed that consumer prices came in exactly as expected, alleviating some traders’ fears that inflation would accelerate. CPI rose 0.2% in October (est = 0.2%) and 2.6% form a year ago (est = 2.6%) while Core CPI rose 0.3% (est = 0.3%) and 3.3% from a year ago (est = 3.3%). There were declines in gasoline, fuel oil and apparel prices, while food, transportation, medical care and shelter rose. The shelter component represented more than half of the monthly increase in prices and continues to be the most stubborn portion of core inflation. The closely watched “Supercore” (core services less housing) increased slightly to 4.38%, the first monthly increase since April, indicating core inflation still remains too high for the Fed.

The BLS also released the Producer Price Index (PPI) on Thursday. PPI measures the change in the price of goods as they leave their place of production, making the index a good measure of inflation from the wholesale level. Headline PPI increased 0.2% in October (est = 0.2%) and 2.4% from a year ago (est = 2.3%). Removing more volatile items Food and Energy, the index increase 0.3% (est = 0.2%). Over three-fourths of the overall increase in the headline number came from services with much of that increase coming from prices for portfolio management.

Retail Sales (not adjusted for inflation) advanced 0.4% MoM (est = 0.3%) with nearly three-fourths of that increase coming from the volatile Motor Vehicle component. The Retail Sales Control Group, which strips out the more volatile categories of consumer spending declined -0.1% (est = 0.3%).

All in all, this week’s data was largely in-line with expectations, but will likely be somewhat disappointing to Fed Officials as price growth remains above a pace that is consistent with the Fed’s target of 2% inflation. As of the time of this writing, markets were still projecting a 62% chance of a 25bp rate cut in December. Looking ahead to next week, we’ll get a look at Housing Starts, Leading Economic Indicators, and Consumer Sentiment.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.