With a light data docket this week, much of the trading activity has been dominated by geopolitical rumblings abroad and speculation about the dynamics of President-elect Donald Trump's incoming administration. Flight to safety trades emerged early in the week after Ukraine made use of its new permission from Washington to use U.S.-supplied missiles on Russian territory and Moscow responded with nuclear threats. Russian leader Vladimir Putin updated Moscow's military policy and "nuclear doctrine" to allow Moscow to respond with nuclear weapons if it is subject to a conventional missile attack that was supported by a nuclear power.

U.S. Treasury yields had already been slipping back from the post-election highs reached as investors considered the tax and tariff plans expected from the incoming administration, sticky inflation readings, and scaled-back Federal Reserve easing bets. That retreat was further fueled by the nuclear sabre-rattling from Russia this week but also aided by speculation that President-elect Trump's pick for Treasury Secretary could land on a relatively familiar face.

Kevin Warsh, a former Fed governor, emerged as a favorite in betting markets early this week, which put his odds of nomination to the top job at the Treasury at 44% on Tuesday. Warsh, who is currently a Visiting Fellow at the Hoover Institution of Stanford University, has a track record of hawkish views on both inflation and deficits and was White House economic policy adviser to President George W. Bush from 2002 to 2006. Markets responded to the idea of a familiar face in stride but odds are constantly shifting and by Thursday afternoon Scott Bessent, founder of the investment firm Key Square Capital Management, had taken the lead with 42% odds.

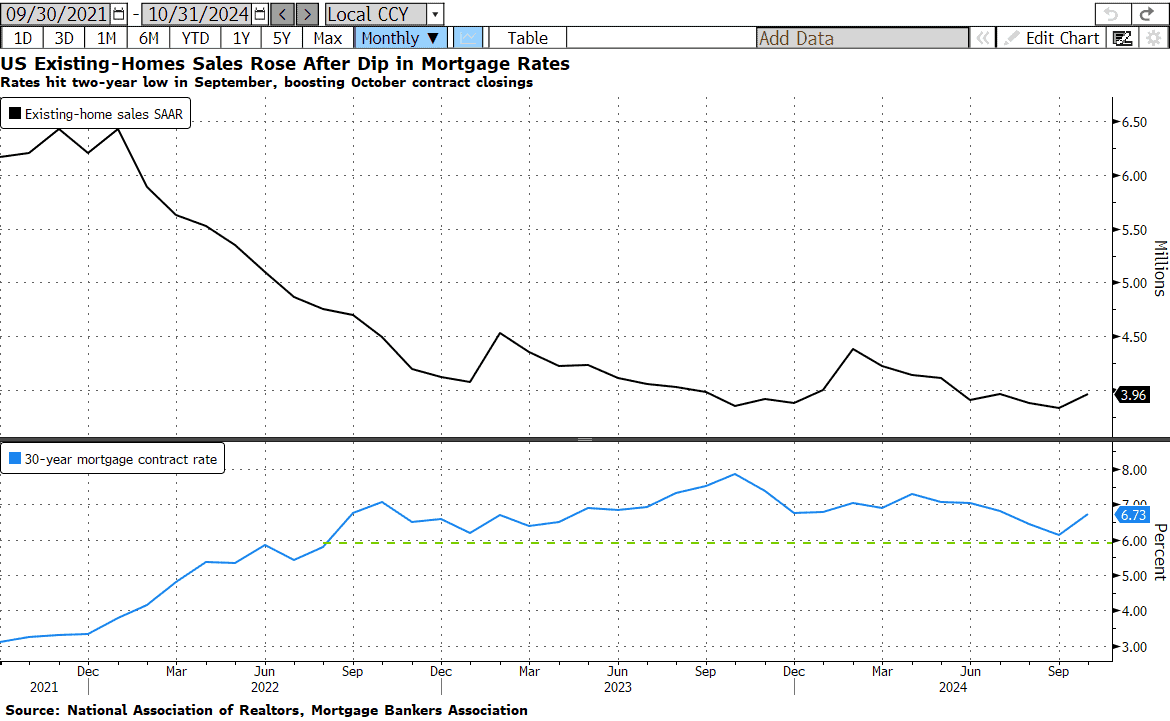

Housing numbers showed some softness this week with housing starts slumping -3.1% MoM in October to 1.311 million units (at an annual rate). That moderately undercut the consensus estimate of 1.334 million. Building permits also dipped -0.6% to 1.416 million units, shy of the consensus estimate of 1.435 million units. Existing home sales, however, were up in line with economists’ median estimates. Sales of previously owned homes rose in October to a 3.96 million annualized rate, up 3.4% from a month earlier.

Next week will be a short one with the Thanksgiving holiday on Thursday and markets typically quiet the Wednesday before and Friday after. However, there are several key readings due for release including the Fed’s favorite inflation gage, Personal Consumption Expenditures (PCE), and the second reading of Q3 GDP both due on Wednesday, as well as minutes from November’s FOMC meeting due Tuesday. We hope everyone has a very Happy Thanksgiving!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.