“To cut rate or not to cut rates…that is thy question.” My high school literature teacher would be proud of my attempt to blend classic Shakespeare with the upcoming December Federal Open Market Committee meeting. The FOMC will meet in just under two weeks to partake in their final two-day policy meeting of the year. There are still some key data releases between now and then with some of those key data releases coming to us this morning in the November job reports. I almost forgot to say it…Happy Jobs Friday!

This morning, the Bureau of Labor Statistics reported that the U.S. added a seasonally adjusted 227,000 jobs in November, slightly higher than the 220,000 estimated. This was up from an increase of 36,000 jobs in October. Job gains were focused in health care (54,000), leisure and hospitality (53,000) and government (33,000), sectors that have consistently led payroll growth for the past few years. The headline unemployment rate, which is based on a separate survey (Household Survey) rose from 4.1% to 4.2%. Expectations were for the unemployment rate to remain unchanged at 4.1%. Worker pay continued to rise, with average hourly earnings up 0.4% from a month ago and 4% on a 12-month basis. Both numbers were 0.1% above the expectations. The household survey showed the economy lost 355,000 jobs in November following a loss of 368,000 jobs in October. Some economists say the household survey does a better job of identifying labor market weakness during turns in the economic cycle. Lastly, the labor force participation rate fell to 62.5% (expected at 62.7%) in November, down from 62.6% in October. On Tuesday, the Job Openings and Labor Turnover Survey, or JOLTS report, from the Labor Department reported 7.744 million job openings for October versus a forecast of 7.48 million. Altogether, this morning’s employment report paints a mixed picture of the labor market, with stronger than expected payrolls growth in the establishment survey, but job losses, declining labor force participation and rising unemployment in the household survey.

Later this morning, the University of Michigan’s Consumer Sentiment Index rose for the fifth consecutive month in December, increasing 3% to its highest reading since May. Republicans’ feelings improved the most, while they declined the most among Democrats, who cited concerns about President-elect Trump’s proposed tariff hikes.

Earlier this week, the ISM Purchasing Manufacturing Index (PMI) rose from 46.5 in October to 48.4 (expected at 47.5) in November. A reading below 50 indicates contraction in the manufacturing section, which accounts for just over 10% of the overall economy. Additionally, the ISM Services PMI registered a 52.1, 3.9 points lower than October’s figure of 56. November’s reading marked the ninth time the composite index has been in expansion territory this year.

A check-in on the markets shows a slightly lower stock market and a small rally in Treasuries with prices up and yields down. The 10-Year Treasury is currently sitting at 4.15% and the 2-Year Treasury at 4.08%.

Next week will mark the last full week before the Fed’s final policy meeting of the year. The Fed and traders will be focused on next Wednesday morning’s release of the latest Consumer Price Index (CPI) data on inflation. Headline CPI is expected to increase 0.3% month over month and 2.7% year over year. Core CPI (excludes food and energy) is expected to increase 0.3% as well month over month and 3.3% year over year.

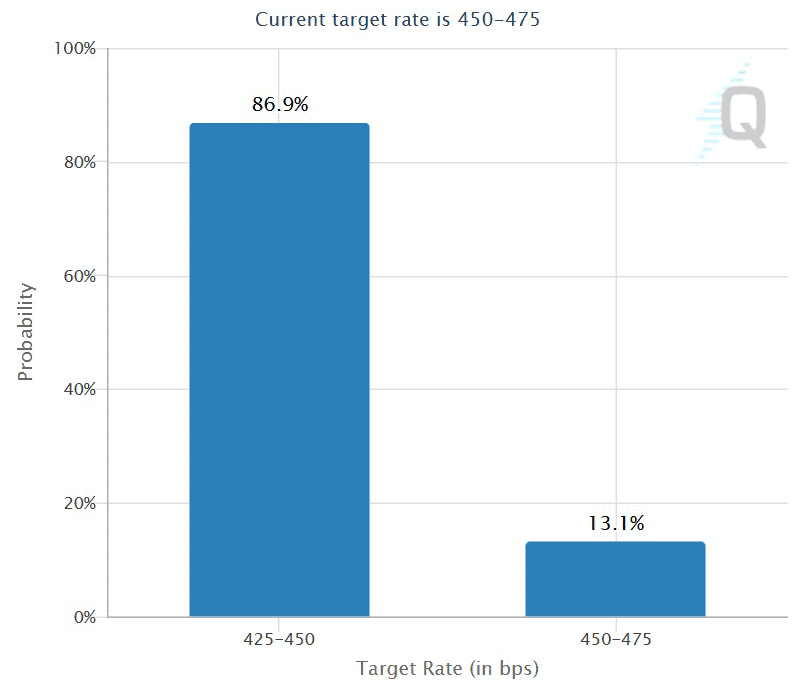

With today’s jobs report and next week’s CPI release, the Fed will have more of their data to make upcoming rate policy decision. “To cut rate or not to cut rates…that is thy question.” The Fed Funds Futures market is now calling for an 87% chance of a 25-basis point rate cut at the December 18th meeting. Before this morning’s job report, that probability was near 70%. Stay tuned and have a great weekend!

CME Group FedWatch Tool – Probabilities for

December 18th Fed Meeting

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.