Treasury yields and the stock market are inching higher this morning driven by general optimism as we near year end; especially in the wake of this week’s tame inflation readings which boost expectations of a Federal Reserve interest rate cut next week. Stocks posted a rally that led the Nasdaq to 20,000 for the first time this week and the S&P 500 to another record high. Gains have been driven by enthusiasm over artificial intelligence and rate-cut expectations.

Attention is now turning to the Federal Reserve's last policy meeting of the year, which begins on Tuesday. The central bank is poised to follow up November's 25 basis point rate cut with another cut of the same magnitude, which would take the fed funds range to 4.25%-4.5%. For 2025, futures markets are betting on just two more 25 bps cuts for the moment as uncertainty around a new administration and the Fed’s responses leave investors with a lot of questions about the economy.

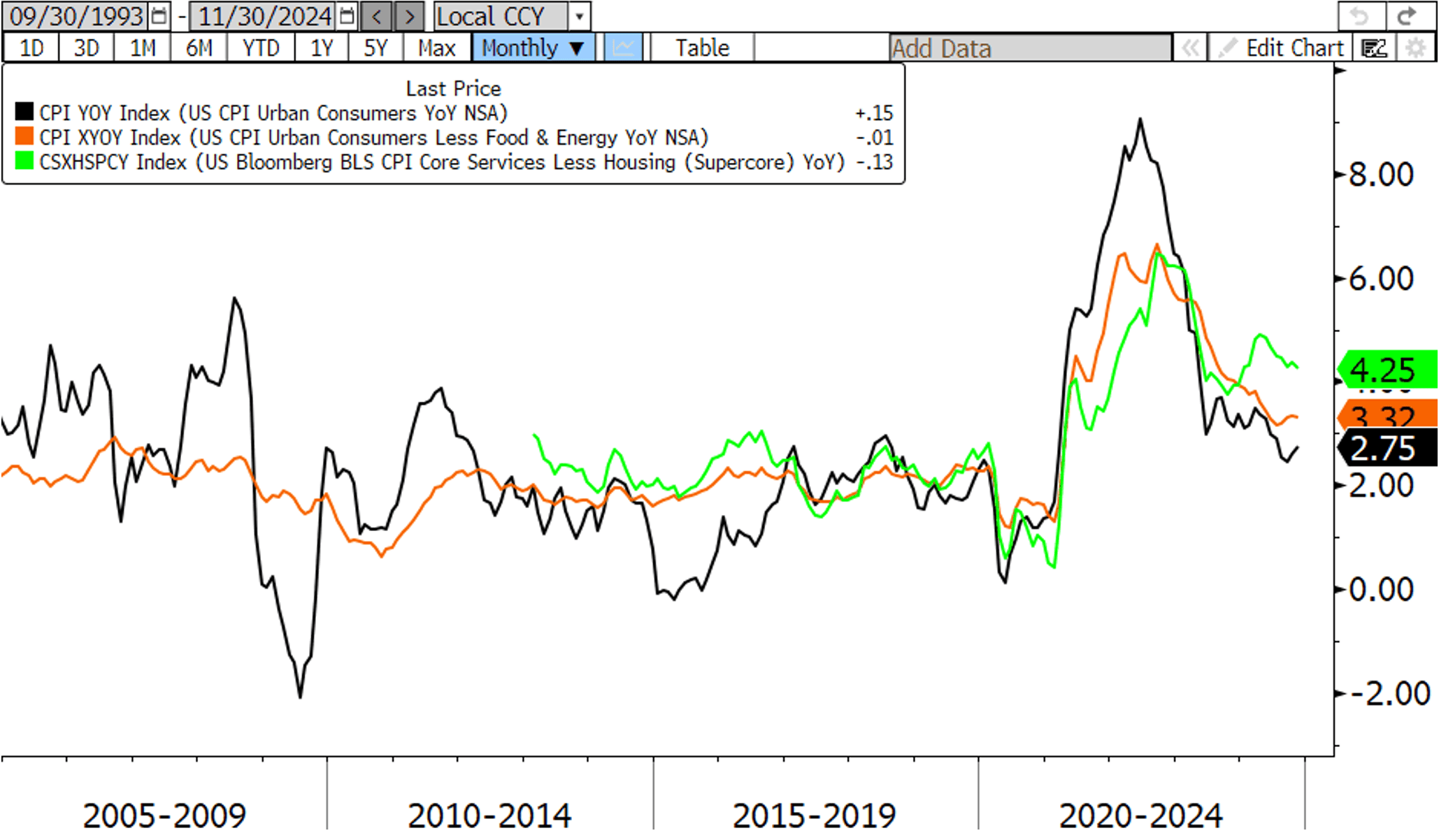

On Wednesday, the Bureau of Labor Statistics (BLS) reported that consumer inflation for November was in-line with economist projections. The Consumer Price Index (CPI) rose 0.3% for the month (est = 0.3%) and 2.7% for the year (est = 2.7%). Core CPI, which strips out volatile food and energy prices, also rose 0.3% (est = 0.3%) for the month and 3.3% (est = 3.3%) for the year. Although the headline increase was slightly faster than the prior month’s increase of 2.6%, there were some positive signs in the underlying trend. Rents, one of the stickier components of inflation, rose at the slowest pace in nearly three and a half years. The rise in motor vehicle insurance, another stubborn category, also moderated. These factors helped slow the increase in services inflation, which has been the most persistent component of inflation. In fact, core services rose by the smallest annual rate since March of 2022.

On Thursday, the BLS reported that wholesale inflation unexpectedly accelerated in November. The Producer Price Index (PPI) rose 0.4% from a month earlier, the most since June, driven by a surge in egg prices. Economists pay close attention to the PPI report because several of its components feed into the Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index. Notably, the categories that contribute to the PCE measure, such as healthcare, portfolio management services, and airfares, showed favorable trends overall, suggesting that November's PCE increase may be more moderate. November PCE will be released on December 20th.

These inflation readings, as well as Thursday’s filings for unemployment insurance, which showed an uptick in applications in the week after Thanksgiving, are among the last key indicators to be released before the Fed’s policy meeting next week and have all but solidified a cut is to come on Wednesday. Also next week, several key readings on manufacturing, retail sales, housing, and GDP will be released as well as the highly anticipated PCE reading on Friday. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.