As the late and great Andy Williams said, “It’s the most wonderful time of the year”! What is better than gathering with people you enjoy, singing songs, looking at big bright lights, all while frantically cheering and yelling? But am I talking about Christmas or the start of the College Football Playoffs? I guess I will just leave that up to everyone to decide for themselves!

This was a week full of economic data, with the main event being the FOMC’s Wednesday meeting where they ultimately cut the Federal Funds Rate by 25-basis points to a range of 4.25%-4.50%. A 25-basis point cut was in line with expectations, however the market reacted to a change from the FOMC in their “Dot Plot”, which is an anonymous snapshot of where the 19 FOMC members project the Federal Funds Rates will be in the future, now only showing 2 rate cuts in 2025 compared to the 4 they were showing at their September meeting. When asked about what would trigger further cuts in 2025, Chairman Powell stated that “As we think about further cuts, we're going to be looking for progress on inflation, we have been moving sideways on 12-month inflation as the 12-month window moves.”

Following the FOMC meeting, the stock market reacted negatively to the new outlook on the future of the Federal Funds Rate. The Dow Jones Industrial Average fell by over 1300 points and the NASDAQ fell by over 700 points on Wednesday. The stock market continues to face difficult news as investors now grapple with a standoff in Congress and a potential government shutdown.

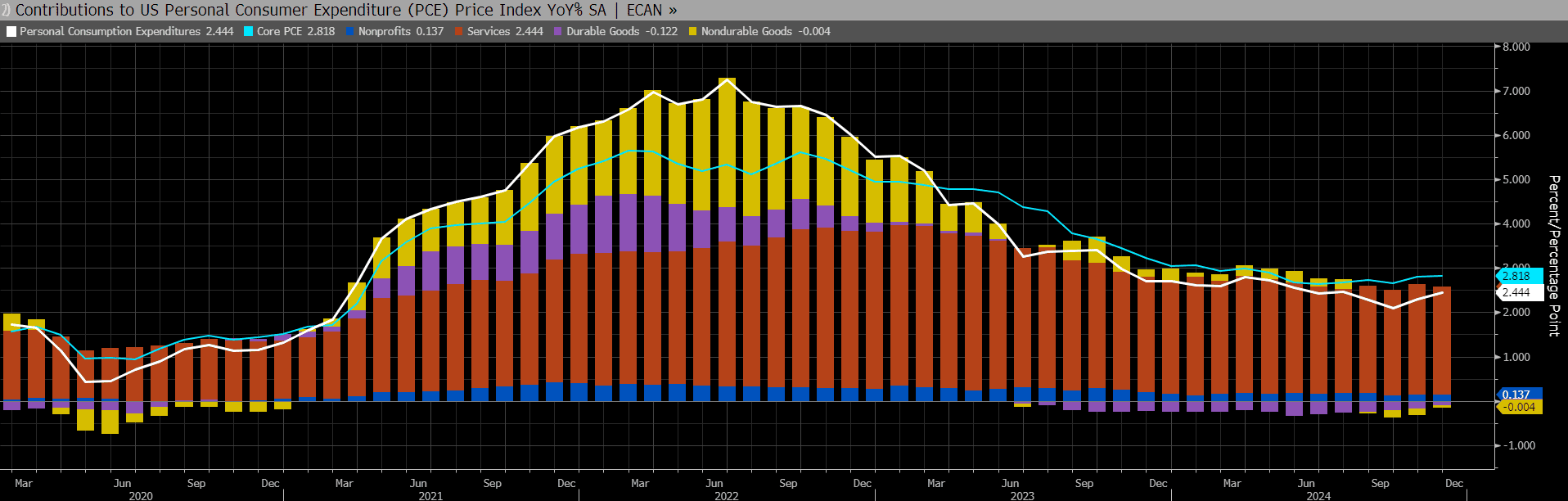

Chairman Powell’s and the FOMC’s worries on inflation may have been somewhat quelled this morning as we received an updated reading on Personal Consumption Expenditures (PCE), the Fed’s preferred measure on inflation. The PCE Price Index rose 0.1% in November and 2.4% from a year ago, against expectations of a 0.2% gain for the month and 2.5% for the year. Core PCE, which excludes food and energy, followed the same trend, coming in at 0.1% for the month (estimated at 0.2%) and 2.8% for the year (estimated at 2.9%). Altogether, this was a very positive inflation report for markets and the Fed with core PCE rising by the smallest amount since May. Bond markets digested the PCE reading relatively well, with bond yields falling this morning. The 2-year UST is down 6-basis points to 4.26% and the 10-year UST is down to 4.5%.

Next week is a relatively mild week for data, as markets are closed for Christmas. Tuesday will bring an update on durable goods orders and new home sales, Wednesday brings good tidings of comfort and joy and Thursday gives us updated numbers on initial and continuing jobless claims. I hope everyone has a wonderful weekend, with safe travels and a lot of football! Merry Christmas!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President, Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.