We started off the week with some PPI talk, then moved on through the week with CPI expectations, retail sales numbers, initial jobless claims, and industrial production numbers. Together with the PPI data already out, it is predicted that the core PCE deflator – the Fed’s preferred inflation gauge, due out later this month – will likely edge up to 2.9%, from 2.8% a month earlier. In combination with other firm data prints this week, it is expected for US treasury yields to continue to climb. The Fed is likely to keep rates steady in January and it looks increasingly likely the rate pause will extend in the fall.

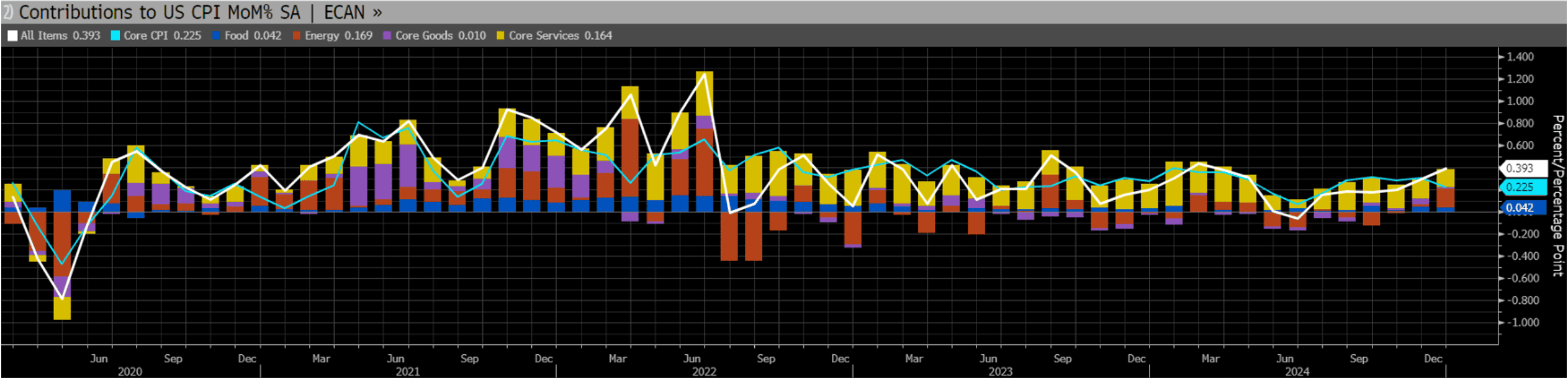

Headline CPI inflation likely rose to 0.44% in December (vs. 0.31% prior) – the highest since February – and core CPI likely printed 0.29% (vs. 0.31% prior). On a year-over-year basis, that would indicate a rise in the headline to 2.9% and keep the core at 3.3% for a fourth consecutive month. Energy costs will likely contribute 17 basis points to the headline due to a 4.0% increase (vs. 0.6% prior) in seasonally adjusted gasoline prices and a 2.5% gain (vs. 1.0% prior) in natural gas costs. Offsetting that, electricity prices fell 0.2% (vs. -0.4% prior). It is expected that inflation in core goods will tick down to 0.2%. Most of the improvement likely comes from used-car prices, which rose 0.1% while new cars increased 0.4%. After December, the seasonal factors for new cars will enter a favorable stretch until mid-2025. Core services inflation likely held at 0.3%, with inflation in the largest services component – shelter – picking up slightly from November’s very soft reading. Year over year, OER inflation likely rose to 4.8% at the end of 2024 – above the roughly 3% pre-pandemic pace.

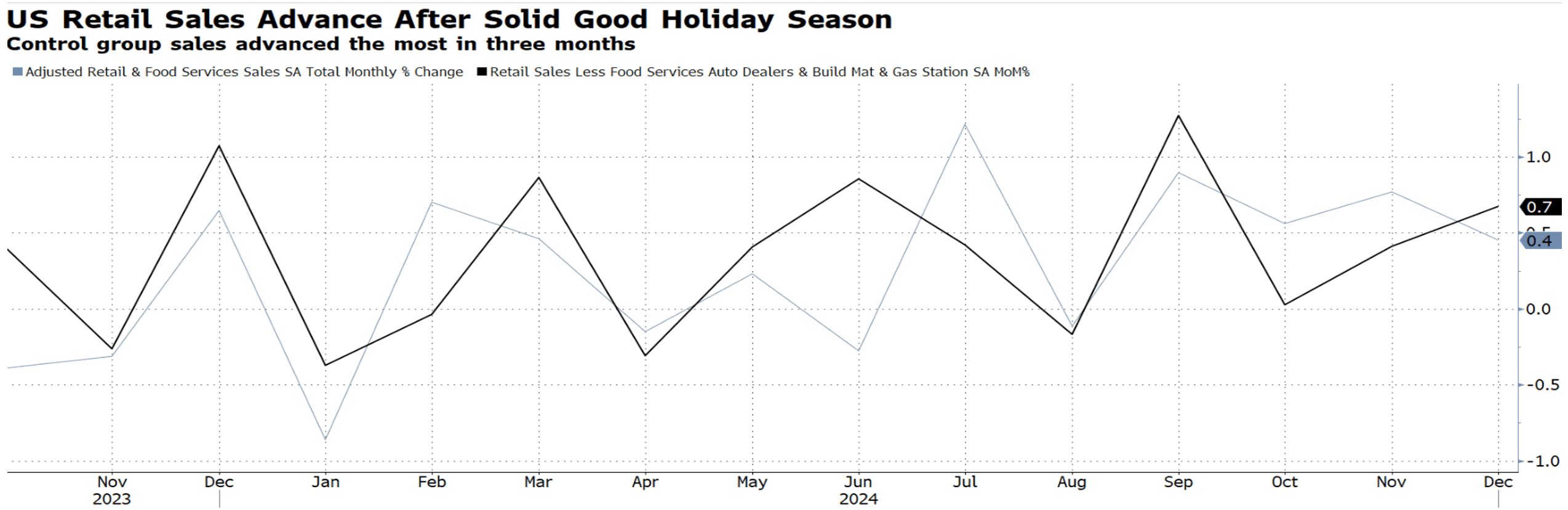

US retail sales broadly advanced in December, indicating strong consumer demand to wrap up the holiday season. The value of retail purchases, not adjusted for inflation, increased 0.4% after an upwardly revised 0.8% gain in November, Commerce Department data showed Thursday. Excluding autos and gasoline, sales climbed 0.3%. The retail data showed so-called control-group sales – which feed into the government’s calculation of goods spending for gross domestic product – increased 0.7% in December, the most in three months. The measure includes food services, auto dealers, building materials stores and gasoline stations.

Jobless claims increased in the week through January 11th as post-holiday layoffs were only delayed, not forgone. Claims in California also picked up and are set to rise further after 180,000 people faced evacuation orders from wildfires. Initial jobless claims increased by 14k to 217k above the consensus estimate of 210k. Seasonal factors expected an increase of 7.3% (vs. 12.6% prior) on post-holiday layoffs, Unadjusted claims surged by 45k (vs. 23k prior). Claims increased the most in Michigan (15.2k), California (13.1k), and Texas (10.7k). They declined the most in New York (-15.1k), Wisconsin (-3.5k), and Washington (-3.5k). Claims could rise ahead after Boeing Co. presented a range of measures to cut costs, including a 10% reduction in the workforce. With 2,192 Boeing employees expected to be permanently laid off in Washington beginning January 17th, that state – which recorded 7,200 initial jobless claims for the week ending January 11th – could potentially face a 30% rise in claims. Overall, however, job-cut announcements eased in December, according to a report from Challenger, Gray & Christmas, Inc. Furthermore, soft data suggests the job market may be stabilizing and reports of layoffs remain rare.

The week ended with some industrial production numbers. US industrial production rose in December by more than forecasted, helped by a pickup in factory output that indicates manufacturing is stabilizing after 2 years of weakness. The 0.9% increase in production at factories, mines, and utilities was the largest since February and followed an upwardly revised 0.2% advance a month earlier, the Federal Reserve data showed on Friday. Manufacturing output rose 0.6%, the most since August, and was helped in part by the resolution of a strike at Boeing Co., after a stronger November increase than initially reported. Production of consumer goods and construction supplies also picked up. Manufacturing, which accounts for 3/4ths of the total industrial production, struggled last year as many companies limited capital spending amid high borrowing costs and inconsistent demand. Factory output declined 0.5% for a second year, the first back-to-back decrease since 2019-2020.

Enjoy the long weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Rachel Howell

Financial Strategist

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.