Happy last day of January and happy Friday everyone! This past week we had quite a few important economic releases, primarily what I am going to now trademark as the “Big 3” (trademark NOT pending), with GDP, PCE and the FOMC meeting. Overall, it has been an interesting week in the American economy. On Monday the NASDAQ suffered one of its largest single day losses in history when it fell by over 600 points after the Chinese company DeepSeek released a new Open-Source AI model to compete with American Companies. AI darling NVIDIA fell 17% after the release, wiping out almost $600 billion in market cap, making it the biggest one-day loss in U.S. History. The stock market has seemed to stabilize with NASDAQ making solid gains toward the end of the week. Bond yields remained stable, with the 10 Year Treasury falling 3.4 basis points to 4.501% this morning.

Wednesday brought us the first of our “Big 3” releases with the FOMC meeting. Ultimately the FOMC left rates unchanged with a target range of 4.25-4.50%, as expected. The language following the release was neutral with Chairman Powell stating that “We see the risks to achieving our employment and inflation goals as being roughly in balance, and we are attentive to the risks on both sides of our mandate.” And “We know that reducing policy restraint too fast or too much could hinder progress on inflation. At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment… We are not on any preset course.” The Fed is ultimately leaving themselves some wiggle room to tackle risks to both the upside and downside of their dual mandate. The next FOMC meeting will take place on March 19th, where current market expectations show a slim chance of a cut. The December 2024 Dot Plot penciled in 2 cuts for 2025, and the Fed Funds Futures Markets seems to believe that first cut will come this summer.

The 2nd of the big 3 was Thursday’s GDP report for Q4 2024. GDP came in at 2.3% Quarter over Quarter, missing expectations of 2.6%. Consumer spending has remained strong, rising 4.2%, however changes in Private Investment fell by 5.6%, which cut more than a full percentage point off the overall GDP figure. Wholesale and Retail inventories, which impact Private Investment, were reported on Wednesday. Both measures missed expectations of 0.2%, with Wholesale inventories coming in at an anemic -0.5% and Retail inventories coming in at -0.3%.

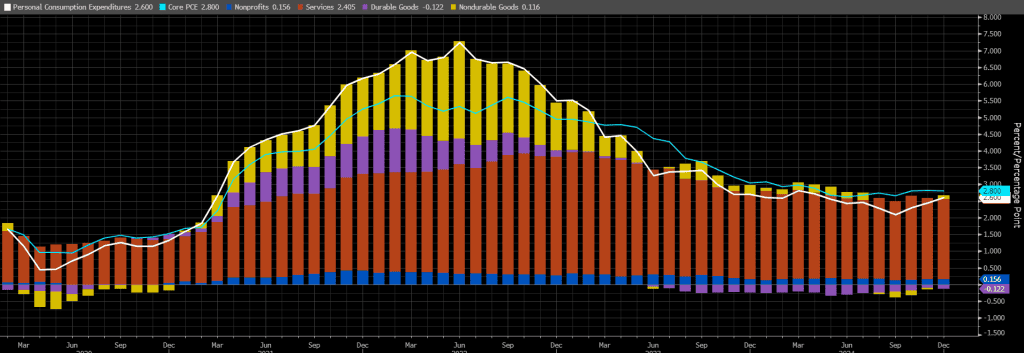

Last, but certainly not least, PCE (Personal Consumption Expenditure) came in this morning at 2.6% Year over Year. This was in line with expectations but is an increase from last month’s reading of 2.4%. An increase in energy prices helped fuel, pun slightly intended, the uptick in PCE. Core PCE, which excludes volatile food and energy components, also met expectations at 2.8% Year over Year. This is the third month in a row with Core PCE at 2.8%.

As we head into the first week of February, we have some more data to gear up for. The first Friday of every month brings us “Jobs Friday”, where we will get updated numbers on Unemployment, Labor Force Participation and Average Hourly Earnings. On Tuesday the U.S. Bureau of Labor Statistics releases their Job Openings and Labor Turnover Survey (JOLTS) followed by the University of Michigan’s Consumer Sentiment report on Friday. Have a great weekend everyone!

Contributions to US Personal Consumer

Expenditure Price Index YoY% SA

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President, Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.