This week began with a heavy focus on tariffs and their potential impact on inflation and the economy, but ended with a heavy focus just how strong the labor market actually was in 2024. On Saturday, President Trump placed 25% tariffs on Canada and Mexico and 10% tariffs on China. Canada responded with their own 25% tariffs on some US imports and markets were spooked that a full-blown trade war had broken out and the threat of ever-escalating tariffs sent stocks and bond yields lower in extended hours trading. But then Mexico negotiated a 30-day delay in the tariffs by agreeing to some of Trump’s terms including sending Mexican troops to the border and Canada soon followed with similar terms and Trump agreed to delayed Canadian tariffs by 30 days as well. And just like that, the Great North American Trade War of 2025 was over before it even started. China however, imposed 10-15% tariffs on a small subset of US exports (e.g. LNG, coal and pickup trucks) and put several companies, including Google, on notice that they could be sanctioned.

So how have markets reacted to all this tariff news? Not much so far. Stocks initially traded lower Monday morning, but then rose throughout the week to recover all the initial losses. Bond yields were mixed with the 2yr rising 6bp and the 10yr falling 5bp. Modest tariffs on Chinese imports will not significantly affect trade, inflation or the US economy. A lot of consumers and some economists believe tariffs cause inflation, but I disagree. If you raise the price of specific goods from a specific country, that is a one-time price adjustment to a small subset of goods, but it does not cause a broad, sustained increase in prices which is the definition of inflation. If consumers don’t have any more money in their pocket, they will simply buy less of the higher priced imports or buy other things. The only thing that can truly cause inflation is an increase in the money supply and by extension, government deficit spending, aka “printing money”.

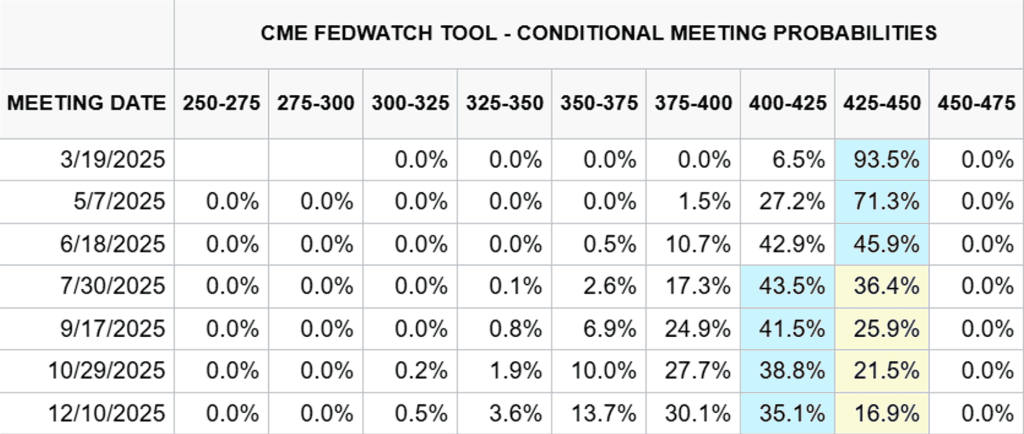

Outside of tariffs, the big news this week was the labor market. On Tuesday, the JOLTS survey showed job openings fell more than 500k to 7.6mm, the second lowest reading in the last 4 years. Wednesday, private payroll firm ADP said the economy added 183k private sector jobs. And then Friday, the BLS showed the economy added just 143k non-farm payroll jobs in January and the unemployment rate fell to 4.0%. They also reduced average monthly employment in 2024 from 186k to 166k, confirming that employment growth was much weaker than initial reporting suggested. While job growth weakened in January and last year’s growth was revised down significantly, markets still believe the labor market remains strong enough to keep the Fed on hold until June or July when the first rate cut is priced in.

Fed Funds Futures Rate Cut Probabilities

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.