This was a busy week for US markets with important policy announcements, notable economic data and a congressional appearance by Fed Chair Jerome Powell. On Monday, President Trump increased tariffs on steel and aluminum imports to a flat 25% "without exceptions or exemptions." The move is intended to help struggling US companies compete but also risks igniting a multi-front trade war with countries like Canada, Brazil, and Mexico who are the largest suppliers of steel to the US.

On Thursday, President Trump followed up with a plan to impose reciprocal tariffs on US trading partners. The initiative would match the tax rates that other countries charge on imports and is intended to equalize the playing field for US and foreign manufacturers. However, under current law these new taxes would likely be paid by American consumers and businesses either directly or in the form of higher prices; although, there is still time for the rates to be studied over the weeks ahead and potentially resolve some of these challenges.

Federal Reserve Chairman Jerome Powell delivered his two-day semi-annual testimony to Congress this week, providing key insights into the Fed's outlook on the economy. He indicated that economic fundamentals remain strong and the Fed sees no immediate need to adjust interest rates, telling the committee “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance.” Other Fed officials echoed Powell's sentiment this week, reiterating that the Fed is in no hurry to further lower rates given so many wider uncertainties.

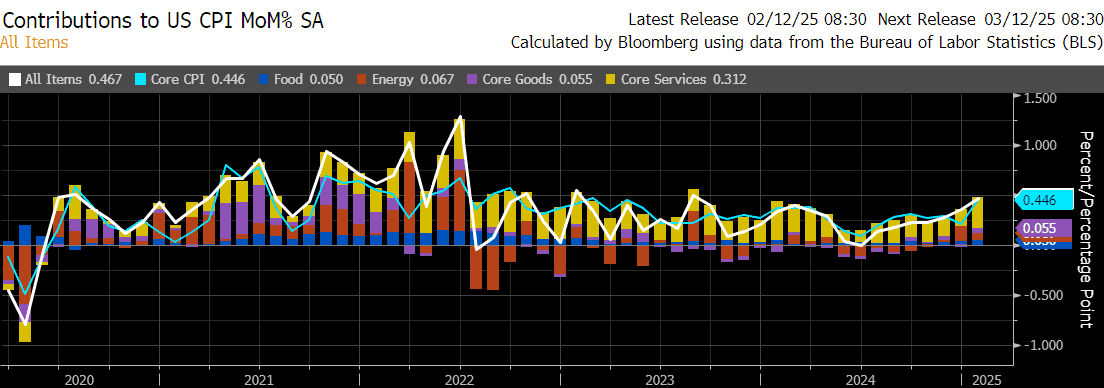

Inflation data presented a mixed picture this week. The Consumer Price Index (CPI) came in hotter than expected on Wednesday, rising 0.5% in January (est = 0.3%) and 3.0% from a year ago (est = 2.9%). Core CPI rose 0.4% (est = 0.3%) and 3.3% from a year ago (est = 3.1%). The price increases were broad-based with most categories showing larger monthly increases than prior months except for apparel where prices fell. The monthly increase was the largest since August 2023 and annual CPI accelerated for the fourth consecutive month since hitting a low of 2.4% in September.

Thursday’s Producer Price Index (PPI) also came in higher than forecast for the month of January, rising 0.4% on a monthly basis and 3.5% annually (vs. 0.3% and 3.3% est). PPI often leads consumer inflation and several of its components feed into the Fed’s preferred inflation measure, Personal Consumption Expenditures (PCE). The disappointing inflation readings initially helped fuel the worst selloff in Treasuries since December, but they quickly rebounded after the PPI print as it signaled a softer PCE print may be to come. The specific categories that go into the PCE calculation actually registered declines for the month of January, which would presage a weaker PCE reading on February 28th.

Finally, Friday’s retail sales data showed a significant downturn in consumer spending, with sales dropping 0.9% MoM (vs. -0.2% est). This marks the largest decline in two years and suggests consumers are still grappling with stubborn inflation, high borrowing costs, and rising debt delinquencies. A separate report from the Federal Reserve Bank of New York out yesterday also showed the share of outstanding US consumer debt that is in delinquency rose to the highest level in almost five years in the fourth quarter of 2024.

Hope everyone has a very happy Valentines Day and a nice long weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.