The long-forgotten fears of an economic slowdown that resurfaced late last week continued to burden markets week, sending shutters across both bonds and stocks. The benchmark 10-year Treasury yield is continuing a steady march downward for the seventh trading day in a row this morning, a slide that has resulted in a nearly 30bp drop. That move is being helped along this morning by news that the Fed’s favorite inflation gauge rose at a mild pace last month and is reinforcing bets that the Federal Reserve will cut rates at least twice this year.

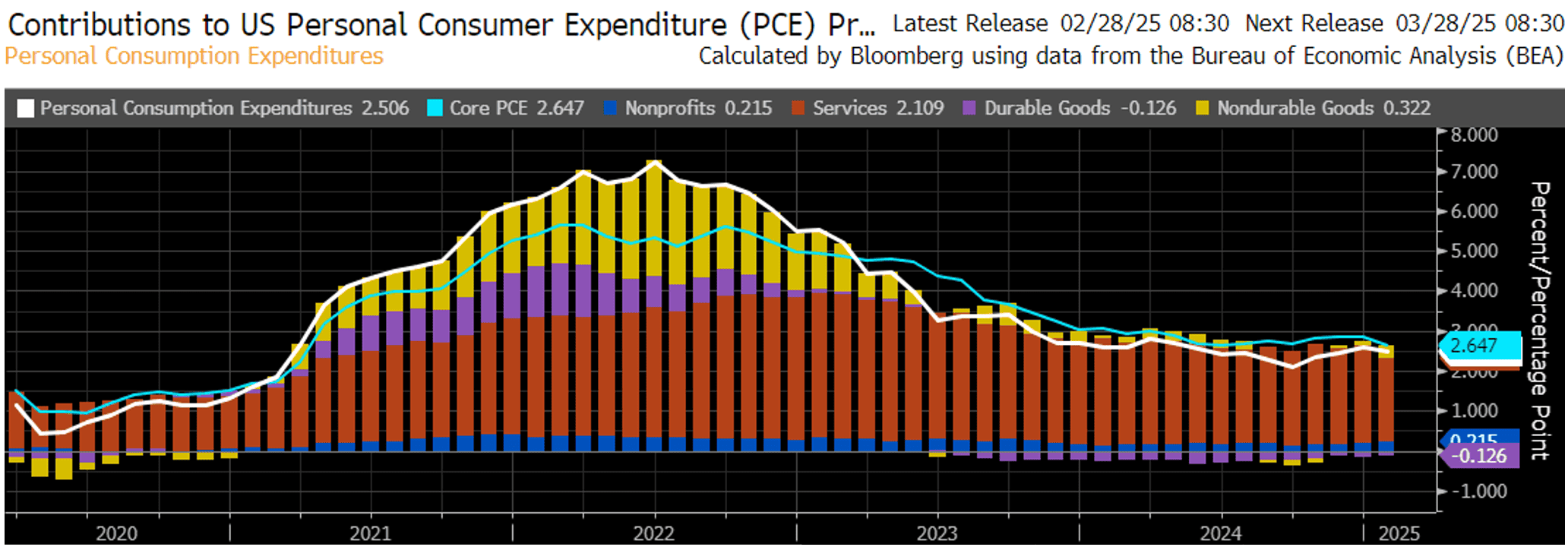

The Personal Consumption Expenditure Price Index (PCE) rose in line with expectations, up 0.3% in January and 2.5% from a year ago. Notably, Core PCE, which excludes volatile food and energy items, also rose 0.3% MoM and 2.6% YoY, matching the smallest annual increase since early 2021. The report was undoubtedly good news for the Fed as it followed a series of other economic readings which had suggested inflation pressures were heating up again.

Also released in the PCE report was data on consumer spending, which showed inflation-adjusted spending fell 0.5% in January, marking the biggest monthly decline in nearly four years. This drop in spending follows a surprisingly poor retail sales reading a couple of weeks ago that showed sales falling 0.9% in January (vs. -0.2% survey), suggesting the economy may be starting 2025 on a weaker than expected footing.

Wall Street appears quite concerned about the resiliency of the American consumer and a potential economic slowdown. All major indices have given up considerable ground over the last two weeks. The S&P 500 lost its 6,000 handle on Monday and the Nasdaq and Russel 2000 have both turned negative for the year.

Business surveys have begun to sputter as well as a host of uncertainty around import duties, immigration, federal worker cuts, and wavering international alliances weigh on firms’ ability to plan and invest. Consumer sentiment is dreary as well. Tuesday’s report from the Conference Board showed consumer confidence deteriorated at its sharpest pace in 3.5 years in February as consumers worry about inflation and tariffs increasing the price of household goods.

At the risk of delivering one too many downtrodden measures, there was also housing data out this week the bears reporting. Pending home sales dropped to a record low in January, down 4.6%, the largest drop since the Covid-19 pandemic. Sales of new single-family homes also fell more than expected in January, dropping 10.5% (vs. -2.6% survey). Persistently high mortgage rates and rising home prices that have resulted in a 49% increase in the median sale price over five years, are clearly sidelining potential buyers (though perhaps we can blame some of this on poor weather too!).

The good news is that Fed easing hopes have gone up a touch this week. The futures market is now pricing in ~2.5 rate cuts by year end. The Fed meets again next month and is not expected to make any changes to the policy rate at that time. However, markets are betting on one full cut this summer in June or July. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.