Uncertainty most certainly took markets for a ride this week. Already-jittery investors were greeted with a full-blown trade war with the US’s largest trading partners to start the week, fueling fears of an economic downturn in the first quarter of 2025. Post-election stock gains were largely wiped out and all three major stock indexes are now in the red for the year. The yield curve also further inverted after mostly normalizing last month. The dollar sunk, corporate credit spreads widened, and futures markets have now upped their bets on the number of Fed rate cuts this year to three.

Market participants are clearly spinning their wheels trying to figure out where the administration’s economic policies are going to take the economy but perhaps the ambiguity on trade policies and geopolitical alliances is deliberate, designed to keep rival counterparts on their heels in trade negotiations. Nevertheless, it appears to be taking a toll on businesses and consumers who signal that they are delaying important purchase and investment decisions until the dust settles.

That, of course, threatens to restrict economic growth in the short term and has caused the Alanta Fed GDPNow forecast, which is a running estimate of real GDP growth based on available economic data for the current quarter, to plummet in recent days. The forecast fell to -2.4% yesterday, reflecting expectations of reduced spending and investment on behalf of businesses and consumers as well as reduced government spending resulting from the DOGE initiatives.

Yesterday, some of the tariff turmoil was put on hold as President Trump suspended the 25% tariffs imposed on Canada and Mexico earlier in the week. Those exemptions expire on April at which time President Trump says he will impose global reciprocal tariffs on all US trading partners. In other words, trade uncertainty is likely to continue to weigh on markets in the near term.

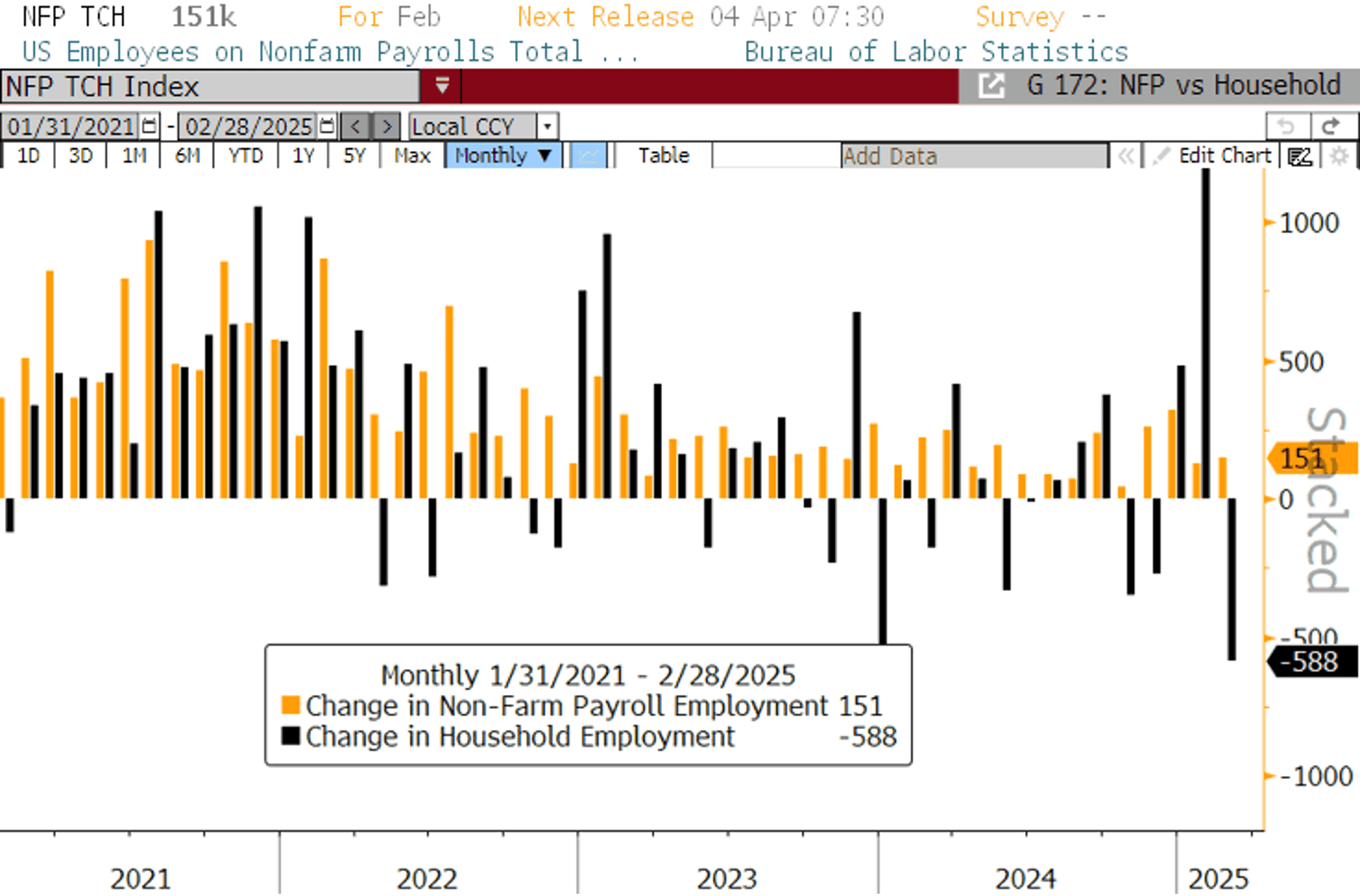

This morning, we got the much-anticipated Employment Situation Summary for the month of February with insights on job growth, wages, hours worked, and unemployment. The report showed February job growth was weaker than expected and the unemployment rate rose for the first time since November. The economy added 151k non-farm payroll jobs (vs. 160k survey). Average hourly earnings rose to 4.0% from a downwardly revised 3.9% the prior month in a sign wages seemed to be stabilizing around 4% after two years of declines.

The separate Household Survey showed a massive 588k loss in jobs and a 203k increase in the number of unemployed workers with 546k workers leaving the labor force. This caused the unemployment rate to rise to 4.1% (vs. 4.0% survey) and the labor force participation rate to decline to 62.4% (vs. 62.6% survey), the lowest reading in more than two years. Finally, the U6 “underemployment” rate, which is a broader measure of unemployment that includes those officially unemployed as well as those working part-time for economic reasons and those not actively looking in the last month but who have looked in the last year, jumped to 8%, the highest level since October 2021, signaling the labor market appears to be weakening.

Next week’s economic data focus will be Wednesday's consumer price report (CPI) which investors fear could fan fears about still-warm inflation. The index is expected to have climbed 0.3% on a monthly basis, but hopefully a notch lower than the surprise 0.5% jump last month, which marked the biggest gain since August 2023.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.