Bond prices are up this morning after hotter than expected inflation data and lackluster consumer spending numbers hit the news wires. The 10-Year Treasury yield is currently 4.297%, down from the open at 4.361%. Personal Consumption Expenditures (PCE) inflation data showed a 0.3% increase month over month and an annualized increase of 2.5%, both squarely in line with expectations. However, core PCE, which strips volatile food and energy items, was up 0.4% MoM and 2.8% YoY, outpacing market expectations of +0.3% and +2.7%.

Today’s stubborn inflation data coincides with new tariff talk this week, including a 25% tariff on vehicles and auto parts imported into the US. The Trump administration also announced plans to impose a round of fresh tariffs on April 2, a day President Trump has dubbed "liberation day." The President has referred to the April 2 tariff announcement as "the big one," suggesting that the plans could be more far reaching than the import tariffs already levied.

Business and consumer sentiment have tanked as tariff plans have escalated over the last several weeks as the uncertainty makes it difficult for businesses and consumers to plan and invest. There are also growing signs of household financial stress emerging as well. According to data from the Federal Reserve Bank of New York, a growing share of US consumers say they are not seeking loans as they expected to be turned down. The share of discouraged borrowers, those who say they need credit but didn’t apply because they don’t expect to be approved, grew to 8.5% in the NY Fed’s latest Survey of Consumer Expectations. That is the highest level on record since the survey began in 2013.

The combination of weak sentiment and growing financial stress among households has elevated concerns that the economy is poised to fall into stagflation if not recession. The FOMC’s own forecast seems to echo these fears. Policymakers indicated they expect slower growth and faster inflation in their latest Summary of Economic Projections released at last week’s policy meeting.

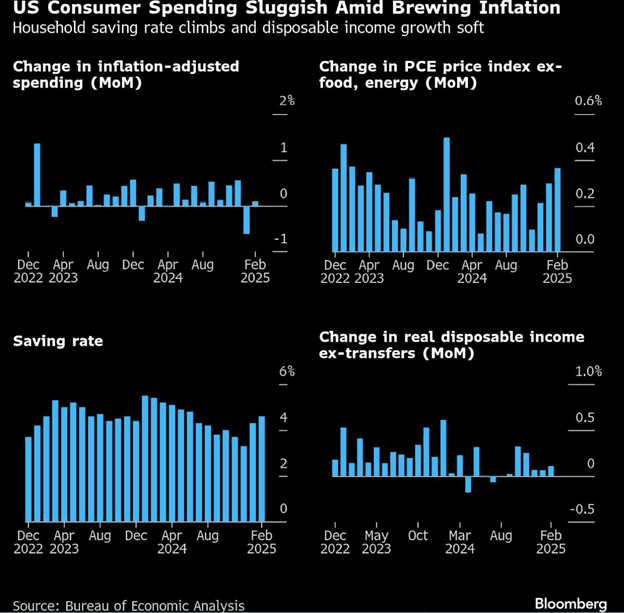

Perhaps the bigger news from this morning’s inflation report was the jump in personal incomes and pullback in personal spending. Incomes grew 0.8% in the month of February, double the +0.4% expected. Spending, on the other hand, was weaker than expected, up 0.4% vs. 0.5% survey. On an inflation-adjusted adjusted basis, consumer spending edged up 0.1% after falling in January by the most in nearly four years.

This morning, another sentiment measure painted yet another dismal picture of how consumers are feeling about the economy. The University of Michigan’s final March sentiment index sank to a more than two-year low, with anxiety over tariffs contributing to the decline. The report showed consumers expect prices to rise at an annual rate of 4.1% over the next five to ten years, a 32-year high. They also see costs rising 5% over the next 12 months and labor market conditions weakening along with increasing unemployment. This obviously has implications for economic growth as consumer expectations frame much of the spending and investment decision for US households.

Next week, the calendar will turn to April and bring on the second quarter. As always, markets will be focused on the slew of employment data that is released the first week of every month, culminating with non-farm payrolls and the unemployment rate on Friday.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.