Short trading week, with Good Friday closing the markets earlier than usual. Good Friday is not the only testament of faith that is taking place in recent or upcoming events. This past Sunday, Rory McIlroy’s completed the ever so sought-after Career Grand Slam at this year’s Masters, overcoming an 11-year major drought. This mirrors resilience investors are exhibiting amid recent financial market turbulence. Despite significant market volatility triggered by new U.S. tariffs and escalating trade tensions, many investors are holding their positions, reflecting a belief in long-term recovery. Just as McIlroy persevered through setbacks to achieve the Grand Slam, market participants are maintaining confidence that despite recent events, American exceptionalism is not dead.

On Wednesday April16th, Jerome Powell addressed the Economic Club of Chicago, highlighting challenges posed by recent U.S. trade policies. Persistent short-term volatility in financial markets following President Donald Trump's "Liberation Day" has fueled speculation that the Federal Reserve might soon respond by lowering its key interest rate or intervening through open market operations. Federal Reserve Chairman, Jerome Powell, expeditiously talked down rate cuts in the near future, quoting “As we gain a better understanding of the policy changes, we will have a better sense of the implications for the economy, and hence for monetary policy”. As expected, the temporary effects of tariffs were a major talking point during his speech, with concerns of high inflation and slower growth echoed for the near term. The chairman did offer some reprieve for long-term investors and consumer alike, mentioning that “Survey measures of longer-term inflation expectations, for the most part, appear to remain well anchored; market-based break evens continue to run close to 2 percent”.

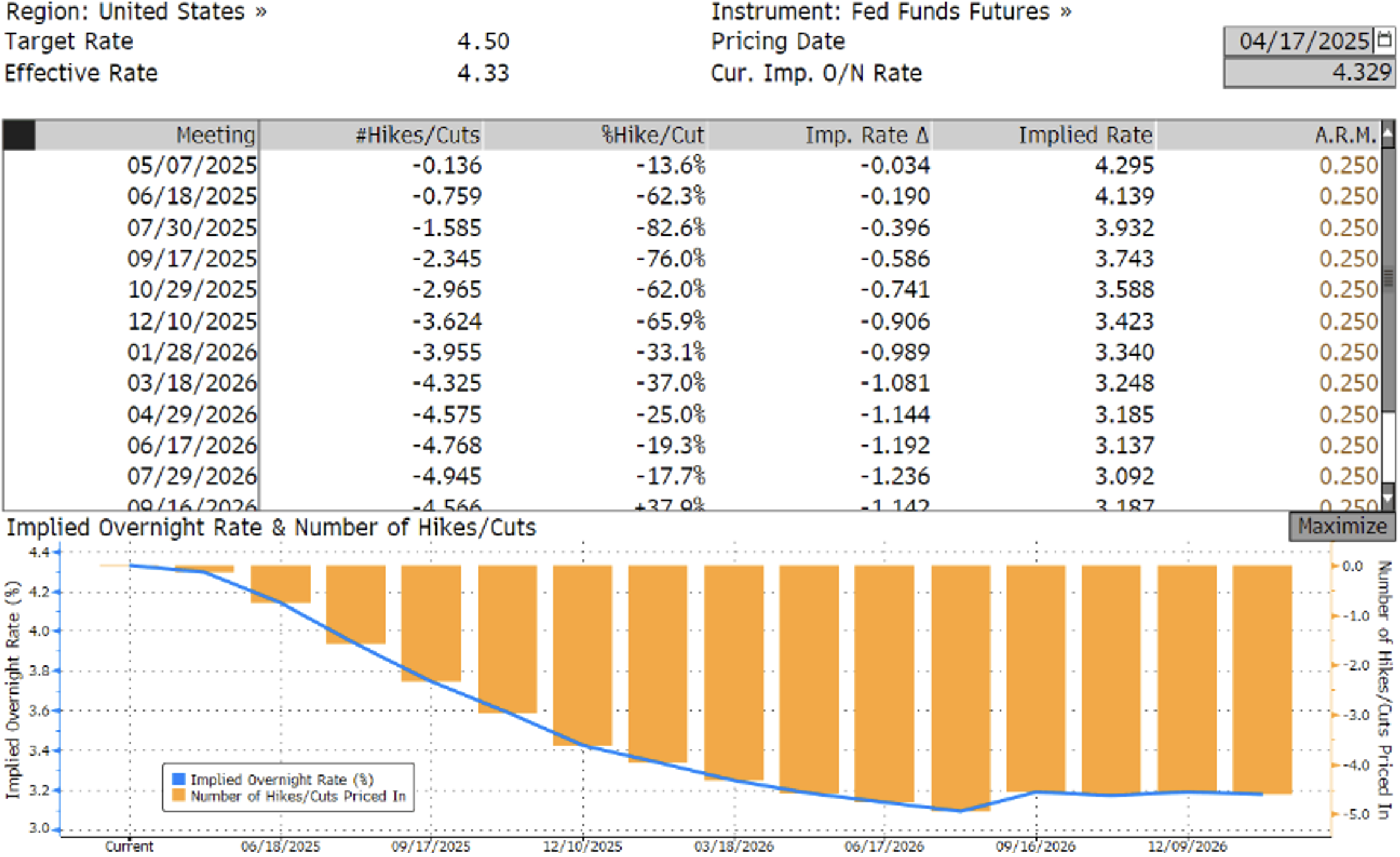

Tensions sparked by the new administration are clearly visible in the world's most liquid markets, foreign exchange, where periods of political uncertainty often trigger sharp movements in currency values. The U.S. Dollar Index (DXY), which tracks the dollar’s value against a basket of six major currencies, including the euro, yen, pound, Canadian dollar, Swedish krona, and Swiss franc, has recently experienced significant downward pressure. Since the beginning of this month, DXY has traded down roughly five percent over the past 17 days. Despite Powell’s, previous and most recent comments, regarding future monetary policy being “data dependent” traders may be overlooking statements from the central bank executive. This is evident in the Fed Funds Futures market, where the implied rate for year-end 2025 dropped from 3.56% on Trump’s “Day of Liberation” to 3.42% today, a decline of 14 basis points.

Next week we have a full slate of Federal Reserve executives set to speak on the outlook of the future U.S. economy, as well as data prints regarding trade, retail sales, business activity and employment. Have a good weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Carson Francis

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.