A wave of forbearance expirations expected this spring has investors anxiously awaiting clarity on what it will mean for the mortgage market. COVID-19 forbearance plans introduced by the CARES Act last year make it possible for any borrower with a mortgage backed by Fannie/Freddie/Ginnie to stop paying their loan for a maximum of 12 months due to pandemic-related hardship. The majority of loans in forbearance today entered forbearance in April 2020. With the deadlines on those loans fast approaching, what happens next is front of mind.

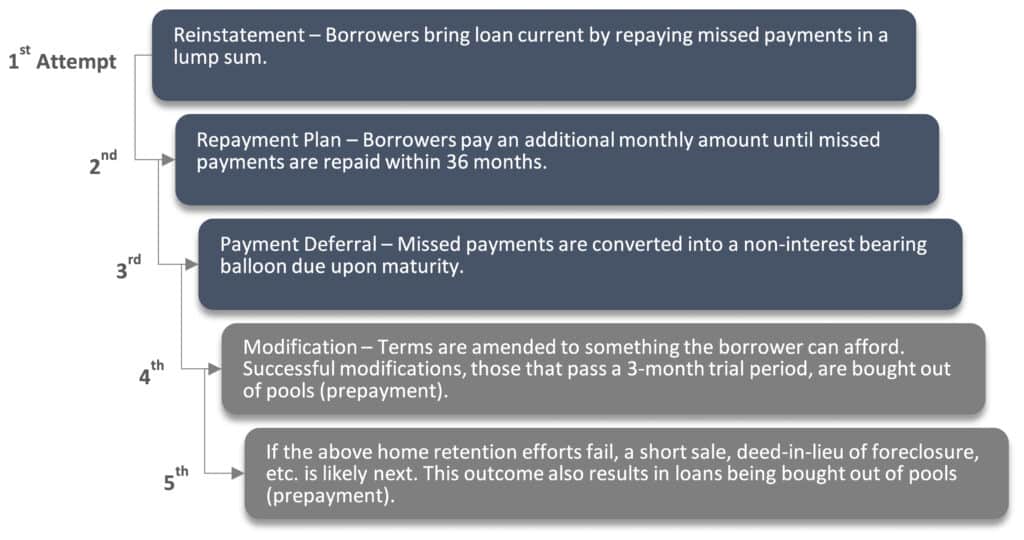

There are several paths a loan can take when forbearance expires. These paths prioritize keeping borrowers in their homes and minimizing disruption to the mortgage market. For conventional borrowers, the exit paths follow the waterfall below.

It is worth highlighting that options 1-3 above all present no actual impact to MBS investors. In those expiry paths, the mortgage remains in the pool and investors continue to receive scheduled principal and interest. Only options 4 and 5 result in prepayments.

While we do not yet know how the impending expirations will ultimately play out, we can make some inferences. Forbearance plans have been available to borrowers facing natural disaster hardships for years, which gives us some historical precedence to draw from. However, there are a number of differences between forbearance today and pre-pandemic forbearance that impact borrower behavior.

One major difference is the root cause of forbearance. Today’s global pandemic differs from a geographically isolated natural disaster in that it affects a wider swath of the country and presents a longer path to recovery. Borrowers are staying in forbearance longer today than in the past and evidence shows that the longer a loan is in forbearance, the more likely it is to experience a credit event (short sale, deed-in-lieu, etc.). That tells us we should expect a large number of credit events as forbearance terms expire this spring. However, there are reasons to believe that loans coming out of forbearance now have a better chance of becoming current than ever before.

First, today’s housing market is particularly strong. This helps borrowers stave off credit events because they can sell their homes and pay off their mortgages in full. This has already led to substantially fewer credit events than we would otherwise expect see. Second, the new payment deferral options introduced by the GSEs make it possible for borrowers to transition back to current without having to come up with additional cash.

These conflicting factors have added to the uncertainty around what will happen when the 12-month terms start to expire. On one side of the equation, the fact that borrowers are spending a longer time in forbearance increases the likelihood of them experiencing a credit event upon expiry. On the other side, borrowers arguably have a better opportunity to avoid a credit event today because of the strong housing market and availability of payment deferrals.

It is estimated that the share of loans in forbearance that will ultimately experience a credit event could be between 0.7%-7.2%. That is a wide range but taking that percentage of the roughly 5% of all mortgages currently in forbearance does not amount to an alarming share of the agency mortgage universe. Further, because these forbearance terms expire on a rolling timeline the impact should not overwhelm the market. This is not to say there will be no impact, there undoubtedly will be, but it does suggest the disruption is likely insufficient to warrant substantial changes to investors’ strategies.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.