Our well-known Interest Rate Risk Monitor (IRRM®)* simulation model allows bank managers to efficiently determine the risk to income and capital that arises from changes in interest rates. IRRM reduces regulatory and accounting burdens and provides “what if” simulations to provide an accurate process for projecting future profitability. It is a powerful management tool as well as a key reporting system for regulatory compliance.

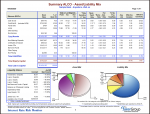

Sample Reports

List of Reports:

Click here to view a full list of downloadable sample reports.

IRRMs Dynamic Liquidity Monitor (DLM):

Click here to download the sample IRRMs Dynamic Liquidity Monitor tool.

Interest Rate Risk Monitor Introduction and Overview:

Click here to download the overview.

IRRM enables you to better manage the future impact of changing interest rates to your institution’s profitability and equity position. Specific program functions include:

- Projected profitability and volatility of equity capital under various balance sheet and interest rate scenarios

- Measurement of price volatility for the entire balance sheet, including modified duration, effective duration, and convexity

- Projected balances and yields per account for 12- and 24-month budgeting purposes

- Comparative changes in net interest income and interest expense under nine different rate shift scenarios

- Monitored asset mix and profitability — both ROA and ROE — over integral rate shift horizons up to 24 months

- Incorporation of embedded options such as principal payments, decay rates, life caps, periodic collars, and reset frequencies for all assets and liabilities

- An unlimited number of simulation analyses

- Unlimited historical data storage

- An unlimited number of accounts

IRRM allows your bank to comply with regulatory and accounting requirements by providing critically important management information.

- GAP Analysis and Rate Sensitivity Measures

- Net Interest Income Change Analysis

- Market Value of Equity (MVE) Analysis for ASC 825

- Balance Sheet Effective Duration and Convexity

- IRRM Webinar Education/Training

Below are four webinar training videos showcasing the features of the IRRM program:

- Part 1: Interest Rate Risk Management: Using the IRRM Model

- Part 2: Interest Rate Risk Management: Using the IRRM Model

- Part 3: Interest Rate Risk Management: Data Entry & Assumptions in IRRM

- Part 4: Interest Rate Risk Management: Back Testing & Assumptions

*The Baker Group, LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

1601 NW Expressway, 21st Floor

Oklahoma City, OK 73118

Phone: 405.415.7200

Toll-Free: 800.937.2257

Fax: 405.415.7392

Check the background of this firm and your investment professional on FINRA’s Brokercheck.