As we move through 2023, the possibility of a recession is at the forefront of most investors’ minds. Fortunately, most municipalities are in a good starting place for a downturn. Tax revenue has soared recently, and federal aid has also helped to boost the balance sheet of state and local governments. Many issuers have reported record high budget surpluses and/or all-time high reserve levels. Municipal bond defaults have been very low at only 0.04% in 2022, down by over 21% from 2021 levels according to Bloomberg data. Further, municipalities generally have weathered economic downturns very well, largely due to resilient tax revenues.

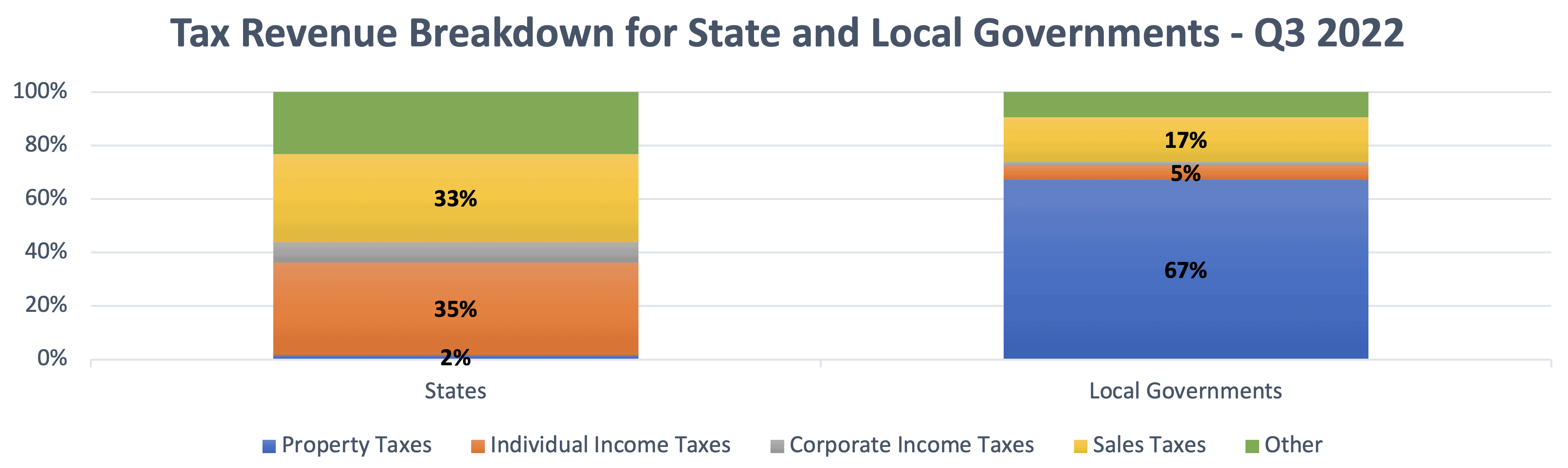

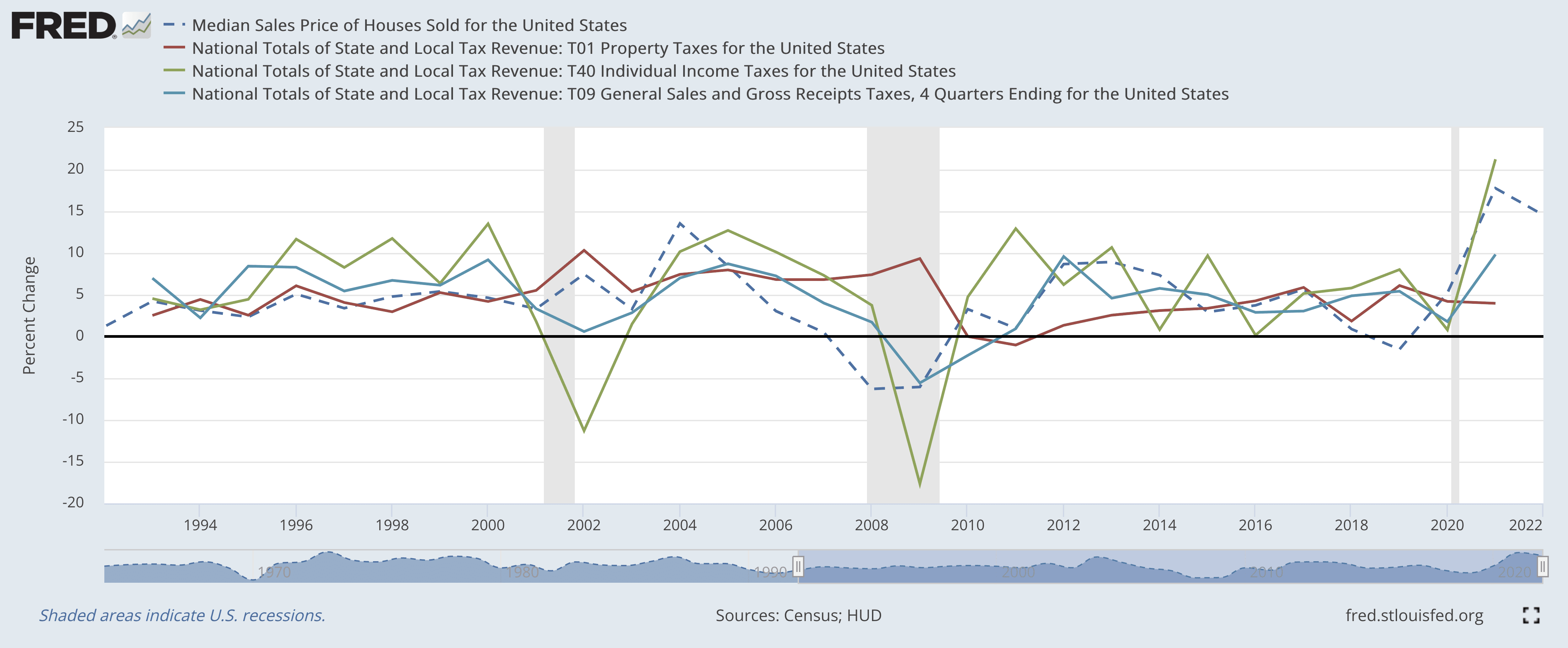

Most local governments rely heavily on ad valorem, or property, tax revenue as shown in the chart above. Property tax revenue rarely declines on a broad basis, but when it does, it tends to lag the economy. Federal Reserve Economic Data (FRED) reveals that while median home sales prices fell by over 6% in 2008 and 2009, property tax revenue increased at the same time, was flat in 2010, and fell by only about 1% in 2011 before it continued a positive trajectory. This is the only time total property tax revenue has declined since at least 1992. Given the recent boom in home prices, it is unlikely that assessed valuations would decline if we encountered a mild recession in 2023.

Sales tax revenues, the second largest source of tax revenue for both state and local governments, also declined for the only time since 1992, during the Great Recession: 5.6% in 2009 and 2.3% in 2010. Sales tax revenue experienced a slowing of the growth rate, but not a decline, during the 2001 and 2020 recessions. However, income tax revenues, a major revenue source for state governments but not usually local governments, are highly correlated with economic activity. In two of the last three recessions, aggregate income tax revenues declined significantly: 11.3% in 2002 and 17.6% in 2009. Despite these declines, state revenues recovered quickly and have since grown tremendously.

On the other hand, economic downturns can worsen existing credit issues and impair elastic revenue streams. Moody’s reports that the frequency of municipal bond defaults increased during and after the Great Recession, with an average of five new issuer defaults per year during 2008-2017 compared to an average of two new defaults per year over the past fifty years. According to Moody’s there were thirty-eight defaults from 2008-2017, excluding Puerto Rico. From 2018-2021, there has been only one default of a Moody’s-rated issuer. However, when expanding the view to include both rated and non-rated issuers, there were fifty-seven issuers that defaulted in 2021 and fifty-two issuers in 2022 according to Bloomberg. This demonstrates the additional risk associated with non-rated municipal bonds, with most of those defaults in the healthcare and development sectors.

In fact, healthcare and development bonds together have accounted for more than 70% of all municipal bond defaults each year since 2018. Issuers without tax support in the healthcare sector have had a volatile few years since the beginning of the pandemic. Margins have been pressured further by inflation and high labor costs amid a nursing shortage.

Credit quality of development districts can vary widely depending on location and primary revenue sources. In some areas, commercial real estate values are depressed as the “work-from-home,” or hybrid work models, weaken demand for office space. Also, bonds issued by Tax Increment Financing (TIF) districts or other development districts may be repaid from a narrow, economically sensitive revenue stream. For example, TIF bonds are usually secured by a tax on an increase in the assessed valuation of that district following a project or improvement. If the value of that area remains flat or declines, revenues may not be sufficient to repay the bonds as planned. In other cases, development bonds may be secured by a tax derived from sales in a specific area, which could be disproportionately affected by an economic downturn depending on the types of businesses in the district.

While past performance is no guarantee of future results, most municipalities are well-prepared for a downturn and may not even see much, if any, decline in tax revenues. However, idiosyncratic risks remain particularly within the healthcare and development sectors, and other weak credits may be further impaired by a recession. Investors should cautiously monitor holdings of these types of bonds, particularly if they are non-rated and don’t carry any additional bondholder protection. Contact your representative at The Baker Group for help identifying at-risk holdings.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dana Sparkman, CFA

Executive Vice President/Municipal Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.