It’s that time of year when families start getting excited about the holidays and management teams at depository institutions start to worry about budget forecasts. Simply surviving 2023 should be celebrated given the many, many hurdles that were thrown at the banking industry. However, before we get too comfortable and switch into year-end mode, it’s important to discuss our biggest challenges from 2023 and if—or how—they may be factors in 2024.

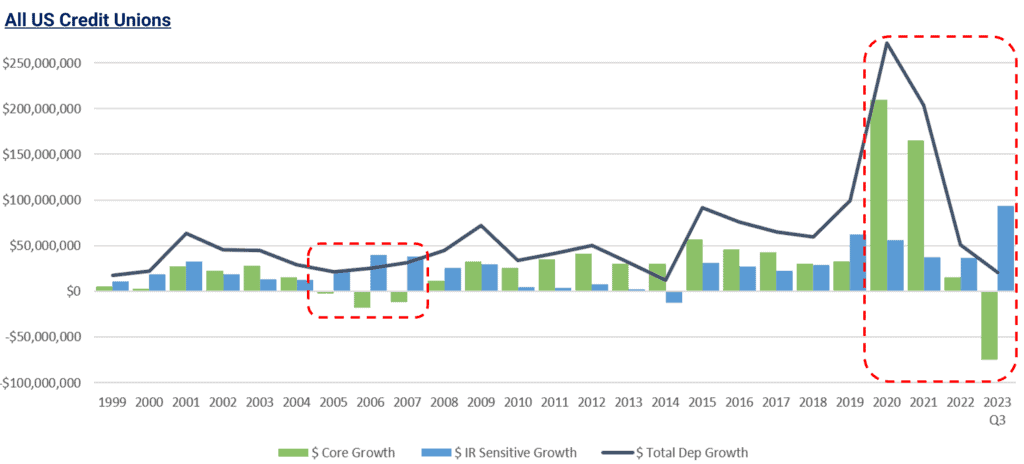

Liquidity risk was certainly the biggest headwind faced in 2023. Even before the failure of Silicon Valley Bank made it a mainstream news story, banks and credit unions were already feeling a historical swing in their liquidity positions. Under the surface there were many variables that helped increase this pressure across the industry. CD specials were the first strategic response (as is typically the case), which led to large amounts of cannibalization at many institutions. On top of paying significantly more to bring in new CD deposits, many unintentionally increased their costs on large amounts of deposits already on their balance sheets. We have also seen core deposits leave at record levels over the past 6-12 months. A lot of this can be attributed to higher costs for monthly expenditures due to inflation but it’s a worrying trend that should be tracked either way.

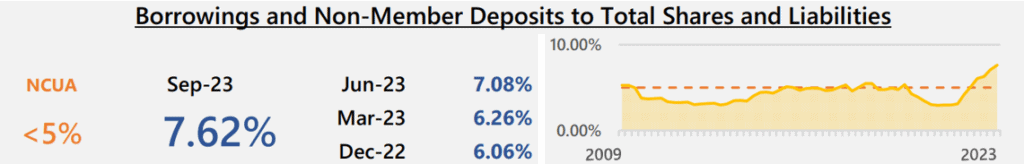

Many institutions also tapped wholesale funding markets at the highest levels going back to at least 2009. This came in the form of borrowings, brokered deposits/CDs, and the new Bank Term Funding Program. While this is a healthy strategic reaction it has certainly led to larger increases in cost of funds and additional regulatory scrutiny. NCUA’s examiner questionnaire mentions a target maximum for borrowings and non-member deposits to total shares and liabilities of < 5%. The industry was above that level for all of 2023 hitting a peak of 7.62% in Q3. This doesn’t make borrowing wrong by any means. It just increases the likelihood that these borrowings and your liquidity position will be a focus topic during your next exam.

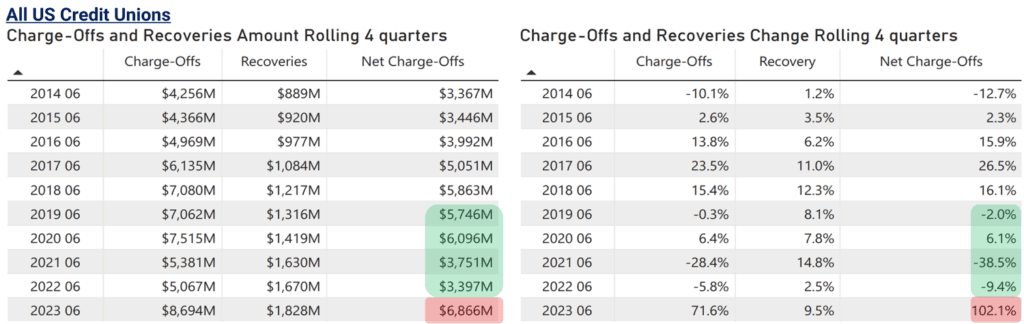

Credit risk is another potential challenge that first showed in 2023 but is likely to be an even bigger hurdle for 2024. After several years of stable or falling charge off amounts the end of stimulus balances, large increases in household debt and the return of student loan payments appear to be taking their toll. In fact, net charge offs through Q2 of this year were up +102% from a year ago and at the largest dollar amount going all the way back to 2014. This will likely further complicate loan pricing discussions in the foreseeable future as institutions attempt to factor in rising cost of funds and credit issues to ensure that minimum margin levels are hit.

Interest rate risk and margin protection will likely be another focus of 2024. Recent market projections have pointed towards the Fed’s tightening cycle being over with arguments shifting to when the first rate cut will take place. Even if the Fed is done, the industry is still working to dig out from the 525bps increase in rates since Q1 2022. While we should never manage our IRR based on where we think rates are going, it’s important to factor in the increased likelihood of falling rates in the near future. The recent surge in rates has offered loan and investment yields that the industry has not seen since 2007. However, as consumer spending power and industry liquidity continue to worsen, it is likely that these yields will not remain in the longer term. At the same time cost of funds appears to be picking up even more speed in terms of increases. Combine these trends in 2024 and it’s likely that many institutions will suffer margin narrowing to a significant degree. In fact, adding margin protection should be one of our top priorities, right after stabilizing liquidity.

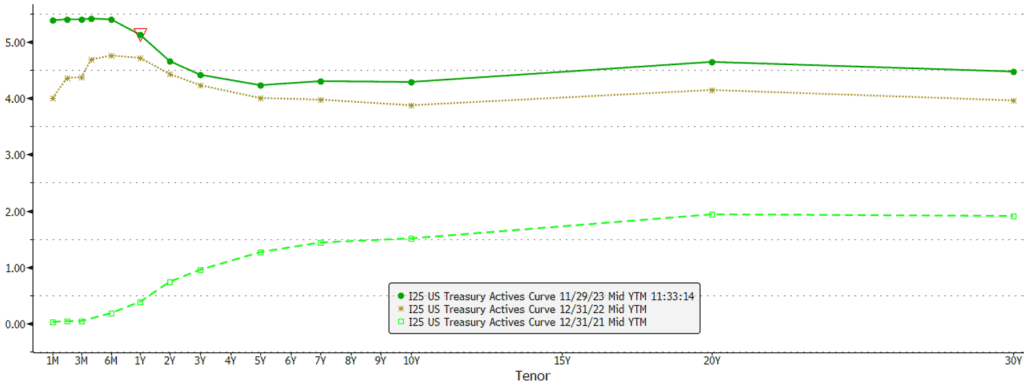

So how do we go about adding margin protection and stabilizing earnings for 2024? Well, the truth of the matter is that only our investment portfolio offers this type of protection. All the high yielding loans that we have added over the past 12-18 months are great for current income and margin. However, as rates fall, many of those loans are likely to refinance and therefore offer very little falling rate margin protection. Within the investment portfolio we can purchase bullet-like securities that cannot be taken away or refinanced as rates fall. Instead, they only increase in market value while locking in today’s higher yields and protecting today’s wider margins. Now this all sounds great, but I understand it is counterintuitive to discuss adding investments in the same conversation as tight liquidity. Nevertheless, if you’re asset sensitive and believe next year may include lower rates and yields, it’s imperative that you find a way to add this falling rate insurance as quickly as possible. That is where portfolio restructurings and investment prefunding come into the conversation.

The idea of restructuring the investment portfolio at the end or very beginning of the year is not new. In fact, there are many institutions that execute this exact strategy every year. What makes this conversation a bit more involved now is the large swings in interest rates and balance sheet positioning that we have seen over the past several years.

At year-end 2021, there clearly wasn’t enough yield pick up or steepness in the curve to justify restructurings. The last thing most institutions needed at that point was more 1% yielding assets on their books. Year-end 2022 was a different story. We had the opportunity to greatly increase asset yields and improve balance sheet risk positions but the speed and magnitude of change in unrealized losses was too great. Many institutions had not yet recovered enough of their lost capital ratios or earnings from COVID to absorb these losses.

That brings us to our current situation as we near year-end 2023. Unrealized losses are only slightly larger than they were at year-end 2022. We have even more yield available to lock in before a potential Fed pivot. Many institutions have now had another year of strong earnings to help recover what was lost in 2020/21 allowing them to consider this strategy without significantly hampering liquidity or IRR.

Another approach for those who need additional margin protection but can’t consider losses in 2023 is to discuss prefunding next year’s investment maturities. If we borrow short term against investment maturities or cashflows in 2024 we can effectively refresh our book investment yields without having to sell any bonds. This enables us to avoid losses on sale while also reducing reinvestment risk next year. While we are increasing book yields, we can also adjust duration to better hedge our IRR. The bank term funding program slated to run at least until March of 2024 is a great option for this approach.

The important takeaway here is that 2024 doesn’t appear set to remove any of our challenges from 2023. In fact, it’s possible that the exact opposite will happen. The good news is that if we follow a proactive balance sheet management style, it is also possible to get out ahead of these concerns. There are plenty of times in our careers when doing “business as usual” is totally acceptable. I do not believe that 2024 will be one of those times and taking the time to prepare now is imperative.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrew Okolski

Managing Director

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.