2025 will undoubtedly be a year of intense tax related negotiations among lawmakers with the looming expiration of the Tax Cuts and Jobs Act (TCJA) of 2017 and Republicans in narrow control. While it is too early to know concrete tax plans from President-Elect Trump’s second term, we have some insight into what he would like to implement as stated on the campaign trail, including the following:

- Extend most provisions of the Tax Cuts and Jobs Act (TCJA) of 2017, except the State and Local Tax (SALT) deduction cap may be raised or eliminated.

- Lower the corporate tax rate to 20% generally, and to 15% for domestic manufacturers.

- Exempt income derived from tips, overtime pay, and social security from taxes.

How these items will be paid for is largely a guessing game at this point, but municipal market participants worry that possible “pay-for” options may harm the municipal market. Some key potential impacts on the municipal bond market are discussed below.

Demand

The common theme of Trump’s wish list is a low tax burden on American taxpayers and companies. All else equal, demand for tax-exempt income diminishes as tax rates fall. Individual tax rates are currently expected to remain at present levels (top rate of 37%), and general corporate tax rates may fall slightly from 21% to 20%.

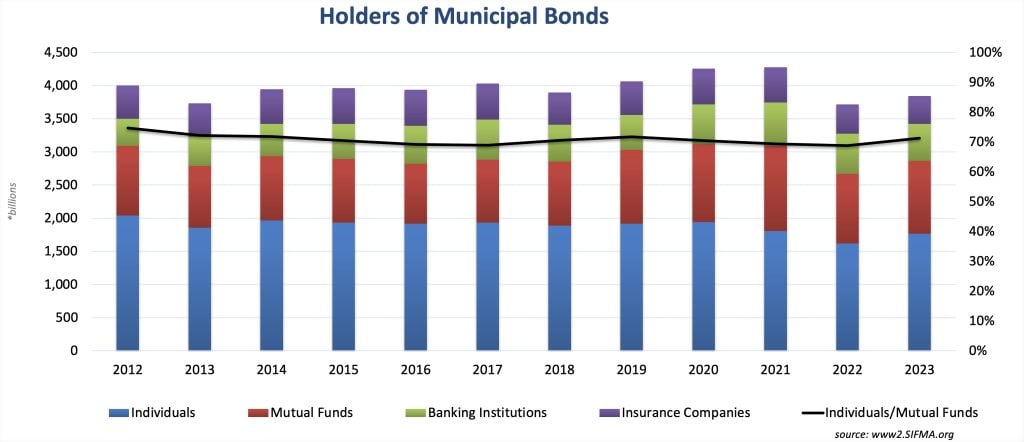

SIFMA data shows that over 70% of municipal bonds are held by individuals and mutual funds rather than by corporate taxpayers, as shown in the chart below. This was the case even before the TCJA slashed corporate tax rates. This means that broad market demand is predominantly driven by individuals rather than corporations. Assuming individual tax rates are not further cut, individuals should still have strong demand for tax-exempt income. However, entities subject to the corporate tax rate may continue to struggle to find value in tax-exempt municipal bonds.

On the other hand, the State and Local Tax (SALT) deduction cap has made tax-exempt income more valuable for residents of high tax states. Trump has expressed interest in raising or eliminating the SALT cap. There has been support for raising the cap to at least $20,000 for taxpayers who file as married filing jointly. The cap is currently $10,000 regardless of filing status. Any loosening of this restriction may hinder demand for tax-exempt income to some extent, but may make it more appetizing for local governments to raise taxes, if needed.

Threatened Tax Exemption

The ability to obtain tax-exempt financing is a tremendous benefit for state and local governments. However, municipal market experts caution that this benefit may be vulnerable due to tax cuts coupled with the recent focus on the national debt. The Tax Foundation reports that if all tax proposals touted on Trump’s campaign trail were enacted, the effect would be a $3 trillion increase in the 10-year budget deficit. Eliminating the tax exemption on all municipal bonds could offset about $36 billion per year according to the Congressional Joint Committee on Taxation. That is a small amount in exchange for being detrimental to financing of local infrastructure. Therefore, it seems unlikely this will happen.

A more likely scenario is that a segment of the municipal market may lose its eligibility to issue tax-exempt bonds similar to the way advance refunding bonds were obstructed by the TCJA in 2017. Private Activity Bonds (PABs) were considered for repeal of the tax exemption when the TCJA was passed, but ultimately retained their tax exemption for qualified purposes then. PABs are likely to be targeted again. Legislators may look to other segments, such as hospitals or colleges, as additional options to repeal the tax exemption and raise revenue. Borrowing costs would rise for any issuers that lose the ability to issue tax-exempt bonds, which could affect their credit quality. Prohibiting tax-exempt issuance by any municipal subsector would marginally reduce supply of tax-exempt paper. Also, any changes in tax free eligibility may lead to a surge in issuance prior to the onset of those adjustments.

As negotiations progress in 2025, it is possible that in the first 100 days of the new administration consequences for the municipal market will be clarified. For now, we expect relatively stable demand for tax-exempt income generally, though banks subject to the corporate tax rate will likely continue to struggle to find value in tax-exempt municipals without seeking long-term bonds. Investors should be watchful for any glimpses of “pay-for” items that could negatively affect issuers or investors.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dana Sparkman, CFA

Executive Vice President/Municipal Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.